Company Overview

The phrase “Internet of Things,” or IoT for short, has come into increasing usage in recent years. As the name suggests, IoT refers to devices that collect and transmit data via the internet. ATM machines were among the first IoT objects when they came out in the 1970s. Fast-forward some four decades later, there are more cellphones, cars, washing machines, headphones, lamps, wearable devices, and various other so-called “smart objects” connected to the internet than there are humans on the planet. According to some estimates, the IoT market is expected to add trillions to the global GDP in the coming years.

One of the beneficiaries of this growth is a little-known (among investors, at least) company called Sierra Monitor Corporation (OTCQB:SRMC). Sierra focuses on the lesser-talked-about Industrial Internet of Things (or IIoT) space. The company designs, manufactures, and sells various Wi-Fi-enabled sensor technologies through two product segments:

- Field servers (53% of revenue) enable local and remote (i.e., cloud-based) monitoring and control of assets and facilities.

- Wi-Fi-enabled fire and gas detectors (47% of revenue) are used to detect hazardous gases and flames and oxygen deficiencies.

Hundreds of thousands of Sierra’s smart sensors have been installed at thousands of facilities around the world, ranging from chemical plants and wastewater treatment facilities to offshore oil platforms and U.S. Navy ships. The company has been recognized as one of the top IIoT vendors by CIO Review magazine.

Enormous Growth Potential

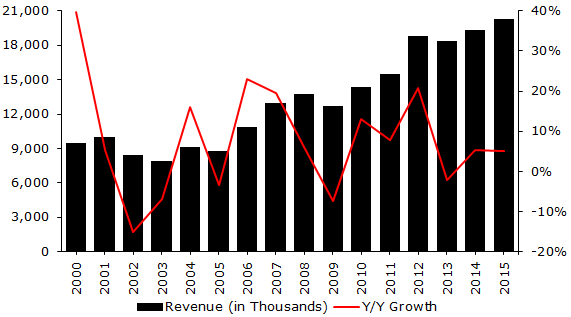

Sierra’s long-term revenue growth has been respectable, hovering in the high single digits (on an annualized basis). However, given that IIoT is still in its early stages, growth is poised to accelerate into the double digits going forward.

Source: A North Investments, Sierra Monitor’s 10-Ks

One particular growth driver for Sierra is the movement to convert heavy-duty vehicles to natural gas due to its lower cost and environmental friendliness. As such, the number of natural gas trucks and buses on roads worldwide is expected to more than double to 3.7 million by 2022. More natural gas vehicles means more natural gas facilities, like fueling and maintenance stations. The need for gas detection at these facilities is critical to catch gas leaks before they lead to disaster. This is a great trend for Sierra, given its leadership in this market segment.

Another specific long-term growth segment is wastewater treatment. With water consumption doubling every 20 years, the only way to meet demand is to recycle and reuse this most essential natural resource. After decades of underinvestment in the space, there’s an increasing amount of spending going on to upgrade old water purification facilities as well as to build new ones. The process of treating wastewater tends to create many often invisible and odorless toxins and combustible gases, which can only be detected using Sierra’s sophisticated detection technology.

These are just some of the individual growth markets that the company operates in that have the potential to become significant revenue generators over the next several years.

Outstanding Fundamentals

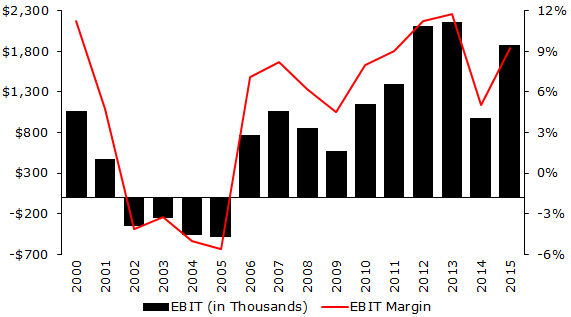

Sierra’s profitability has seen a total turnaround over the past 15 years. As illustrated in the table below, EBIT margins went from negative in the early 2000s to high-single digit positive during the last few years. It should be noted that some of its newer offerings – particularly the new field server-supporting cloud solution – have relatively high learning curves, which creates some “switching costs” for customers. Going forward, these switching costs should result in higher customer retention and, in turn, a rise in profits and cash flow.

Note: This article uses adjusted EBIT. This is calculated as follows: Adjusted EBIT = EBITDA – CapEx +/- non-recurring items. Some might recognize this as Warren Buffett’s “owner earnings.” It gives a more accurate picture of Sierra’s true earnings power.

Source: A North Investments, Sierra Monitor’s 10-Ks

Speaking of cash, Sierra has plenty of it – $4.2 million worth and zero debt. Around $102K of this growing cash pile is being returned to shareholders every quarter via dividends. At $0.04/year, this currently provides a 3% yield to shareholders, as well as some additional income to insiders who control well over 60% of outstanding shares. Given this substantial insider ownership, as well as the favorable tax treatment given to dividends, it wouldn’t be surprising to see the quarterly payout increased substantially going forward.

Significantly Undervalued

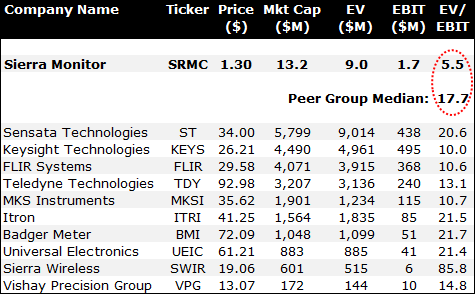

Despite its large growth potential, expanding margins, and robust balance sheet, Sierra has a market cap of only $13.2 million. Subtracting the previously mentioned $4.2 million in net cash from this brings us to an enterprise value, or EV, of only $9 million. Putting this valuation in perspective, the company generated $1.7 million in normalized EBIT over the past 12 months, which equates to a 5.5x EV/EBIT multiple – a nearly 70% discount to the IIoT peers shown below.

Note: EBIT is normalized (i.e., cyclically adjusted) for valuation purposes. This is done by taking the median 10-year (2006-2015) EBIT margin and multiplying it by trailing 12-month revenue.

Source: A North Investments

The reason for this enormous discount is the same that plagues all small publicly traded companies – lack of coverage. No independent research analysts cover the company. Even here on Seeking Alpha, very little has been written about it (only three articles, including this one). This lack of coverage creates inefficiencies in the pricing of micro-caps like this, which makes them a stock picker’s dream.

And that brings us to the ultimate question: How much upside does Sierra have? I believe 10x EV/EBIT (still a 40%-plus discount to peers) is an extremely conservative estimate. This would imply a fair value of just over $2.00/share – or more than 55% upside potential from the current price of $1.30/share. If we applied a more peer-like 17.7x EV/EBIT multiple – which, I believe is still very conservative given Sierra’s outstanding fundamentals and large growth potential – the fair value would be $3.30/share, or over 150% upside potential from the current price. In short, no matter which way you slice it, Sierra is ridiculously undervalued.

Key Risks to Consider

All investments come with some level of risk, and Sierra is no exception. Here are the key risks to consider before investing in this stock:

- Softness in the energy sector has negatively impacted the construction of new oil & gas facilities – which, in turn, has led to weaker demand for Sierra’s fire and gas detectors. Demand is unlikely to recover until energy prices rebound.

- Sierra’s operations are concentrated at a single location. If anything were to happen to this building – like, for example, a fire – it would have a material adverse effect on the business. The fact that the company doesn’t carry sufficient business interruption insurance doesn’t help matters either.

- Insiders have a greater than 60% ownership stake, giving the stock a float (or shares available for public trading) of just 3.7 million shares. This creates two main problems: (1) the high insider ownership gives outside investors little say in what happens at the company; and (2) the small float means that even a small spike in trading volume could cause significant stock price volatility.

- The tiny trading volume is another risk worth mentioning. Average volume hovers around 5,000 shares, which could make it somewhat difficult for larger investors to enter/exit large trades in a timely (and profitable) fashion.

Summary and Conclusion

Sierra is a wonderful business trading at an even more wonderful price. Experienced micro-cap investors who know how to deal with the low float and tiny trading volume are likely to realize significant gains. The valuation points to upside of at least 55%, and possibly as much as 150%, over the next 24-36 months.

Disclosure: I am/we are long SRMC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.