The rise of the ‘internet of things’ – items other than computers that are connected to the internet – means our homes now bristle with gadgets designed to make them more efficient, comfortable and cheaper to run.

From intelligent thermostats to intruder surveillance systems and leak detectors, follow The Mail on Sunday’s guide to high-tech robots designed to take the hassle out of housekeeping.

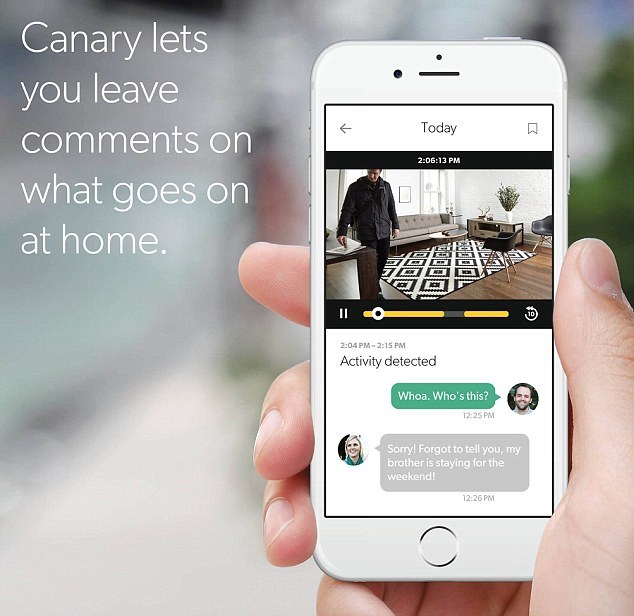

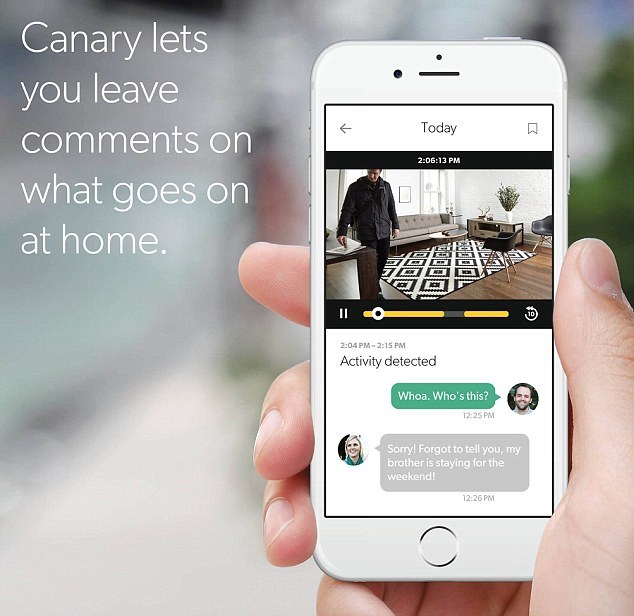

Some might find it comforting to receive periodic alerts on their phone with a message announcing: ‘Activity detected at home while alarmed’.

But others, being miles from home and told there might be an intruder in their property, would be unnerved.

Suck it up: More of our household systems are tuning in to the internet

The first alerts I received when I recently tested a Canary home security device were triggered by my husband returning from work; the cats waking from an afternoon nap; my eldest daughter working from home (without telling me); and our cleaner dusting the mantelpiece.

The motion-activated footage was recorded and stored temporarily in the ‘cloud’ – data stored on the internet – for me to view at my leisure.

Luckily, I had no reason to then tap on the Canary app on my phone to summon the police or trigger a 90-decibel siren, though the devil in me was seriously tempted.

The Canary is a mini-tower the size of a digestive biscuit packet with a camera installed to spy on the house, alerting homeowners by text to goings-on in their absence.

Similar security gizmos include Cocoon, a discreet tennis ball-sized camera that is clever enough to learn the usual comings and goings of a household after a few days. It then only issues an alert to an owner’s phone if activities stand out from the norm.

The Cocoon was developed at the Digital Garage in East London, a high-tech start-up incubator supported by insurance giant Aviva. Based in Hoxton, in the heart of London’s ‘Silicon Roundabout’, independent businesses and boffins work on new technologies for the benefit of homeowners and the insurer.

On the ball: The Cocoon acts as a security monitor. Top: Alerts sent via the Canary app

Insurers are keen to tap into connected home developments because such technology can help reduce claims and potentially cut premiums.

Pet owners can use such devices to keep an eye on their cats or dogs. Or they can buy specific systems, such as Pet Cube, and then interact with their pets from afar.

Some financial incentives are already available to customers using connected devices.

Policyholders with Zurich insurance, for example, can buy a Cocoon at a discount and pay 10 per cent less for their home cover.

Paul Heybourne, digital innovation and new business director at Aviva, says: ‘This is just one of the areas where new technology is likely to impact on homeowners for the better. It’s great for us as we are in the business of protecting people’s homes.’

He is also interested in the potential of the Roost Smart Battery that can turn a standard smoke or carbon monoxide alarm into a smart one. Heybourne says: ‘We want to help customers stop small incidents in the home from becoming big problems.

‘By using a smart battery this allows the customer to know if they have an issue wherever they are and take action. This type of technology is interesting for us because it is easy to install and could provide significant benefits.’

Water leaks and drips that go unnoticed for weeks or even months cause millions of pounds of damage each year – and are the second biggest driver of home insurance claims.

Many homeowners without insurance are forced to pick up the tab on their own. The LeakBot, a pressure sensor developed by HomeServe Labs, part of home assistance group HomeServe, is designed to put an end to this irritation and cost.

The device clips to a mains water supply and identifies leaks early, from dripping taps to overflowing baths.

Warning: Danielle and Carl Preece, with Eden and Celeste, say a LeakBot could have helped

It is programmed to spot when water has been flowing constantly for 20 minutes or more and alerts a homeowner to potential trouble by mobile phone. The warning can be ignored if it is simply a family member taking a long shower.

If there is an issue the householder can be put in touch with an engineer to fix the problem.

The gadget connects to SIGFOX, a low-cost network devised specially for the internet of things that bypasses wi-fi and mobile networks. It uses batteries that last up to five years.

Aviva, keen to reduce the volume and cost of leak claims, recently signed a deal with HomeServe to hand out the gadget free or at a discount to selected home insurance customers. It will roll out the scheme more widely later this year.

Someone who hopes such a device will help him in the future is Carl Preece, 54. The retired landscaper and green keeper, who is married to Danielle, 43, recently had to make a claim for £600 on the couple’s home insurance for water damage.

Carl says: ‘We noticed a smell in our utility room but it was only when we found the soap powder was wet that we realised there was a long-standing leak.’

Carl adds: ‘The leak had soaked into the cabinets. It must have been happening for at least a week. If we’d known straight away we could have stopped it before there was any serious damage.’

For those too lazy to turn the radio on or switch on a laptop to get an update on the news or weather, there are ‘virtual’ personal assistants. These are apps that can be linked to smart phones or speakers in the home.

The software is activated by voice and the personal assistant responds to commands.

Amazon’s Alexa app, for example, can on request warn about bad traffic on a planned journey, look up train times, turn on music or select articles on demand from newspapers. It can even order items from its online shop.

It can be used with an Echo, a cylindrical wi-fi speaker, or a shrunken version called a Dot, designed to be planted in several rooms.

Similar assistants include Siri from Apple, Google Now for Android while Facebook has a version called ‘M’ in development.

Savings of 10 per cent a year can be made on heating bills by keeping a house cold when you are out and then turning up the dial when you get back in.

Insurers are keen to tap into connected home developments because such technology can help reduce claims and potentially cut premiums

Although a central heating timer is a common option for managing temperatures, an intelligent thermostat takes this one step further by letting homeowners adjust the heating from afar on their phone or tablet, such as on the way home from a night out.

The main smart thermostats available include Cosy, Nest, Hive, Tado and Heat Genius.

Consumer group Which? says such gadgets best suit busy households whose members are comfortable using apps.

But it warns they are not suitable for those moving home in a year or so as they are unlikely to recoup the installation cost in lower bills. Nor are they practical for the forgetful who may neglect to activate the thermostat remotely.

Another option is to keep an eye on energy usage using a lower cost digital monitor. The idea behind them is to provide the information that persuades members of a household to alter their energy use behaviour, and encourage more efficient use of energy.

According to the Energy Saving Trust, usage can drop by between 5 and 15 per cent in the first year of using a monitor.

Most are designed to check electricity consumption but provider Loop Energy Saver offers a device for both electricity and gas – plus a built-in comparison service that displays the best energy deals in the market.

Monitors: can be purchased from £30 – £100 for each fuel. Loop Energy Saver offers a package covering both for £60.