Intel Corp. announced an agreement to buy Israel-based Mobileye N.V., a maker of automotive vision technology used for advanced driver assistance systems (ADAS) and fully autonomous vehicles.

The deal, valued at $15.3 billion, would set up Intel as the premier provider of autonomous vehicle chip and machine-vision technology for the ADAS industry, which the company estimates will grow to $70 billion by 2030.

A MobileEye EyeQ2 chip used in a Hyundai Lane Guidance camera module.

The purchase also marks the largest acquisition of an Israeli high-tech company.

Intel CEO Brian Krzanich said during a conference call today that the deal combines “the eyes of the autonomous car with the intelligent brain that actually drives the car.

“Intel provides critical foundational technologies for autonomous driving, including plotting the car’s path and making real-time driving decisions,” he said. “Mobileye brings the industry’s best automotive-grade computer vision and strong momentum with automakers and suppliers. Together, we can accelerate the future of autonomous driving with improved performance in a cloud-to-car solution at a lower cost for automakers.”

While a relatively small company of 600 employees, Mobileye is a giant in the nascent but fast-growing forward-looking driver assistance camera field, where it owns about 70% to 80% of the market, according to IHS Automotive. Mobileye is a Tier 2 automotive supplier that works with all major Tier 1 suppliers, who sell to automotive giants such as General Motors and Volkswagen AG. With the exception of Toyota, Mobileye supplies all 27 major automakers.

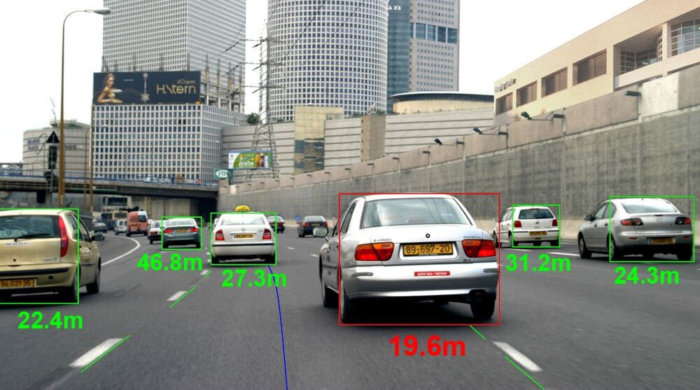

Mike Ramsey, a research director at Gartner, said Mobileye’s small, single-camera automotive vision system is both inexpensive and effective. It “uses a chip…that has a vision system embedded on [it] that recognizes vehicles, signs, pedestrians and lane lines and makes automatic emergency braking and lane-keeping possible.

“It is working on much more powerful chips that use multiple cameras and other sensors to perform semi-autonomous and autonomous driving applications,” Ramsey said. “This is a logical move for Intel, which is hoping to take a strong position in the self-driving car market.”

Mobileye

Mobileye

This image shows how Mobileye’s vision system works in collision avoidance systems.

ADAS and vehicle alert systems include a variety of enabling technology such as infrared sensors, sonar, Light Detection And Ranging (LiDAR), cameras and mapping systems. Over the past decade, Mobileye has used integrated circuits from STMicroelectronics for its machine-vision technology.

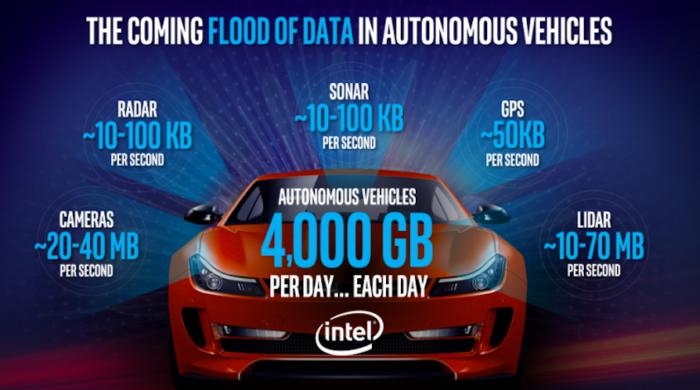

Intel’s role in autonomous driving technology also involves the processors that will be embedded in autonomous cars, as well as the computers within vehicles that process data from ADAS systems. Along with enabling autonomous and semi-autonomous driving, information collected by onboard computer systems sends data back to automakers to help improve the vehicle and self-driving technology.

“While Mobileye’s revenue is small — relatively speaking — it is producing a 30% profit margin and has a very large backlog of business,” Ramsey said. “It has outstanding contracts to produce self-driving systems for several automakers and has a partnership to build a white-label self-driving system with Delphi, a huge automotive supplier/integrator.”

Intel Corp. displays its automated driving technology at the Automobility LA conference in 2016.

Egil Juliussen, director of research at IHS Automotive Technology, called the Intel/Mobileye deal “a pretty big event in the autonomous driving and automotive world.”

“At the semi-conductor level, Intel has been trying to get into this for some time. So this helps them there — at the software level as well. This helps them at the system level,” Juliussen continued. “So they’re pretty well positioned to be a pretty good supplier for the whole automotive industry, all the way from over-the-air software upgrades to autonomous driving.”

While by far the largest, Mobileye is not the first ADAS technology company in which Intel has invested. In January, the chip maker announced it was buying a 15% stake in Netherlands-based HERE, which makes digital maps and location-based services for semi- and fully autonomous vehicles and the internet of things (IoT) industry.

Intel and HERE plan to jointly develop a “highly scalable, proof-of-concept architecture” that provides real-time updates of high-definition maps for self-driving vehicles and will “explore opportunities” in IoT and machine learning.

Intel

Intel

In November, Intel’s investment arm, Intel Capital, announced plans to invest $250 million dollars in autonomous vehicle technology.

“These investments will drive the development of technologies that push the boundaries on next-generation connectivity, communication, context awareness, deep learning, security, safety and more,” Intel said.

Intel’s acquisition of Mobile Eye also furthers two trends: The semiconductor industry consolidation and the entry of tech majors into the auto sector through acquisition, such as Samsung’s acquisition or Tier 1 auto supplier Harmon, according to Paul Asel, managing partner at venture capital firm Nokia Growth Partners.

There has been an ongoing consolidation in the semiconductor industr primarily driven by the Internet of Things and new sensor based markets, such as automated driving.

For example, Qualcomm announced last fall it was acquiring IoT, automotive and security technology supplier NXP for $47 billion. Softbank bought chip-maker ARM for $32 billion last year, primarily for its mobile chip technology.