Global X Internet of Things Thematic ETF (NASDAQ:SNSR) started trading in September 2016 and is the only ETF targeting the internet-connected world. The ETF is off to a reasonably good start as shown in the stock chart below.

SNSR stock chart from inception

The ETF invests in stocks of companies operating in the Internet of Things “sector,” including companies that provide services, solutions and/or products related to the development of connected devices and the internet of things “industries.”

I borrowed the above paragraph from a financial site that was describing the Global X ETF. I put quotes around “sector” and “industry” to emphasize that IoT is considered an industry or sector, when in reality it is in fact not either.

Before I go any further with this article, I have to confess that I have a personal bias against Internet of Things (IoT). In my opinion, it is not an industry, sector or emerging technology of any sort, but an ill-defined, sensationalistic marketing scheme, with outrageous predictions regarding its future.

There are claims of 6 billion currently deployed devices, growing to 20 billion in a few years. The problem with this entire theme is that every wireless device and any device that could conceivably be connected indirectly to the internet is considered IoT.

For example, if you own a Fitbit (NYSE:FIT), and you can download your heart rate to a computer that could connect to the internet, then the Fitbit is IoT. Another example, the RFID devices that are embedded into product packaging, a practice done for the last 20 years, is IoT. Your electronic components that have a Bluetooth interface are IoT. Drones, autonomous vehicles and wearables are all considered IoT. The problem with IoT is that the ability to connect to the internet is a feature for most products, not a reason for being. In many cases, an Internet connection is actually a problem due to privacy and security concerns, not a solution.

This is one area where I have an issue with SNSR. The underlying holdings are a mish-mash of products from different sectors that may connect to the internet. The internet connectivity is just a feature, a small piece of a bigger picture. Below are some of the top holdings that fall into this category:

DexCom (NASDAQ:DXCM) produces continuous glucose monitoring systems.

Mobileye (NYSE:MBLY) is a provider of leading edge autonomous vehicle vision sensors.

Rockwell Automation (NYSE:ROK) provides industrial control solutions.

Sensata Technologies (NYSE:ST) manufactures products and systems that address safety and environmental concerns, control products and electromechanical sensors.

Garmin (NASDAQ:GRMN) provides GPS-enabled navigation products in the Auto, Aviation, Marine, Outdoor and Fitness industries.

The next issue that I have is that most companies involved with IoT are either large conglomerates, or large technology companies and IoT is one small part of their entire business. SNSR holds companies such as Johnson Controls Intl (NYSE:JCI), STMicroelectronics NV (NYSE:STM), Intel (NASDAQ:INTL), Honeywell Intl (NYSE:HON), to name a few. IoT is lost in the noise of these companies.

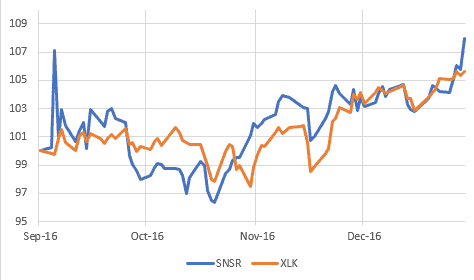

What it boils down to is that SNSR has very few pure IoT connectivity holdings. When you buy SNSR you are essentially buying a technology ETF under the guise of an emerging technology fund. Below is a chart of stock prices (normalized) for SNSR and Technology Select Sector SPDR ETF (NYSEARCA:XLK).

Normalized price chart of SNSR and XLK

Not surprisingly, the performance of SNSR since inception has been very close to XLK, a broad technology ETF. So instead of buying this IoT ETF, why not buy a company that deals specifically with connectivity, thus capturing the broad IoT movement?

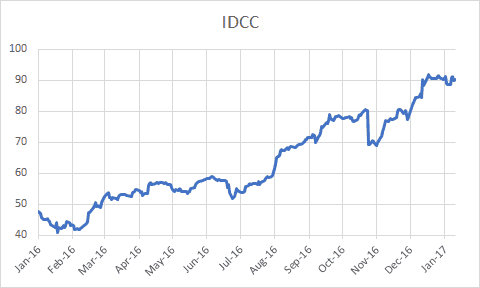

InterDigital, Inc. (NASDAQ:IDCC) is such a company. It develops solutions for enhanced wireless communications for use in digital cellular and wireless products and networks. As of December 2015, IDCC had a portfolio of approximately 20,400 patents and patent applications related to the fundamental technologies that enable wireless communications.

IDCC 1-year price chart

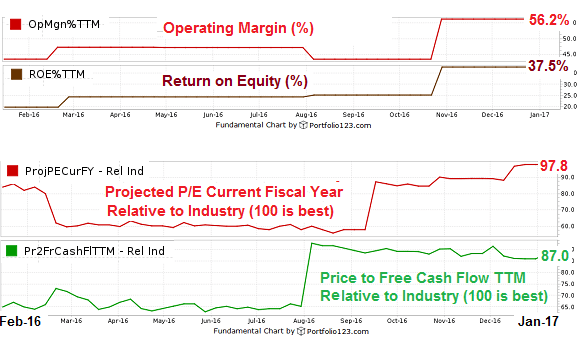

According to data provided by Portfolio123, IDCC has an operating margin of 56.2% and Return on Equity (%) trailing twelve months (TTM) of 37.5%. IDCC also has ratings against its industry peers for projected P/E ratio of 97.8, and price to free cash flow of 87. Note that 100 is the best rating, 0 is the worst.

IDCC fundamentals

I, for one, would prefer to buy this single stock, InterDigital, Inc., that is positioned for growth in wireless connectivity, rather than the Global X Internet of Things Thematic ETF.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.