October 26th, 2016 by Joshua S Hill

Smart grid, battery storage, and energy efficiency companies raised $102 million in venture capital funding during the third quarter of 2016, according to new figures from Mercom Capital, while residential and commercial battery storage projects raised $625 million in project funds.

Mercom Capital Group, a global clean energy communications and consulting firm, released its regular report of funding and mergers & acquisitions (M&A) for the smart grid, battery storage and energy efficiency sectors this week, revealing that together the three sectors raised a total of $102 million in venture capital (VC) in the third quarter.

The company with the largest funding round was an efficiency company, ecobee, which raised $35 million from the Amazon Alexa Fund, Thomvest, and Relay Ventures. The remaining top 5 VC funded companies are as follows:

Smart grid venture capital funding specifically came to $11 million over seven deals in the third quarter, the lowest level of venture capital funding for a quarter since Mercom began tracking activity. This compares poorly with the $222 million over 15 deals which the sector took in during the second quarter of this year, and the $81 million over 12 deals a year earlier.

Overall, seven venture capital investors participated in smart grid deals in the third quarter, compared to 46 just last quarter. There was only one round of debt financing announced, for $250,000, and eight separate M&A transactions.

Battery storage venture capital funding was similarly down, with only $30 million over nine deals compared to $125 million over 10 deals. Again, things were much better earlier in the year, with $125 million over 10 deals being made in the second quarter, and $96 million over nine deals in Q3’2015.

Venture capital funding was spread over six separate sub-technologies — supercapacitor, lithium-based batteries, energy storage management software, energy storage systems, thermal energy storage, and flow batteries. Meanwhile, a total of 22 investors participated in funding for the sector, while debt and public market financing for the sector totaled $51.6 million over three deals.

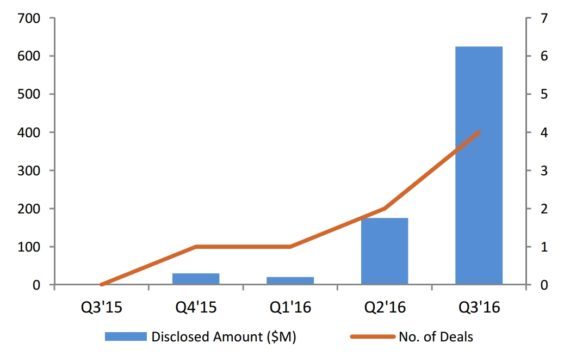

The good news is that it was a record quarter for battery storage residential and commercial project funds, which collectively raised $625 million over four deals, compared to only $175 million in two deals in the previous quarter. The largest deal went to Tabuchi America, which raised $300 million in project financing for residential solar-plus-storage installations. The largest commercial project went to Advanced Microgrid Solutions, which secured $200 million in funding from Macquarie Capital.

Finally, venture capital for energy efficiency companies fell again, drawing in only $61 million over five deals compared to $86 million over nine deals in the previous quarter. A total of 17 investors participated in VC deals, and debt and public market financing came to $328.2 million over two separate deals — one of which made up the lion’s share, the Renovate America’s eighth securitization deal for $320.2 million. There were only two separate M&A transactions in the quarter, compared to seven in the quarter previously.

Drive an electric car? Complete one of our short surveys for our next electric car report.

Keep up to date with all the hottest cleantech news by subscribing to our (free) cleantech newsletter, or keep an eye on sector-specific news by getting our (also free) solar energy newsletter, electric vehicle newsletter, or wind energy newsletter.