Microsoft (NASDAQ:MSFT) has delivered a rapid transformation under CEO Satya Nadella. After his first few weeks as CEO, Nadella described a Mobile First, Cloud First vision on which strategic and organizational decisions would be evaluated. He has stuck to that vision ever since and the results are dramatic. No longer is “mobile” defined by a device as was the case previously. Mobile now means mobile or computing on whatever platform a consumer chooses, wherever they want. Cloud doesn’t really mean just cloud. Cloud is a concept that enhances mobility. They want Azure to succeed as a product. But only because the cloud is where the disruptive innovation resides and is implemented. The phone is simply a powerful user interface. Winning the interface war is consumer electronics as Apple (NASDAQ:AAPL) investors have learned given the earnings multiple afforded them. Delivering on Cloud First, Mobile First re-establishes Microsoft as a technology leader, not an “old technology” company.

Partnerships are for the first time in vogue at Microsoft. Control the source code with an operating system and undocumented APIs? Not these days. Now we see a partner OR compete approach. Examples are everywhere. Windows for free on smartphones. Microsoft and Amazon (NASDAQ:AMZN) were the drivers of the new Partnership for AI initiative. Open source initiatives abound even with Azure. But make no mistake that they still compete as Tableau (NYSE:DATA) and Salesforce.com (NYSE:CRM) have found. Business intelligence, data visualization and sales force automation are critical to the customer requiring an AI-driven approach to the most important emerging market: The Internet of Things “IoT”.

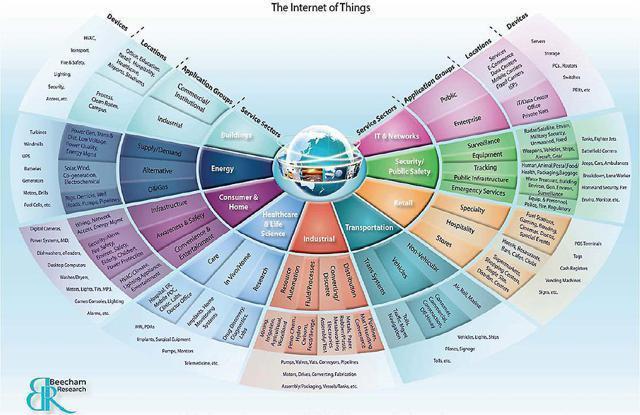

Investing in technology companies can be challenging, especially for those of us not well-versed in engineering sciences. Instead, consider the technology components powering the potential of the IoT. The IoT is still being defined which shows its breadth. At first many simply viewed it as a bunch of sensors tagged to things and connected to the internet by Wi-Fi. This provided data which was warehoused in data silos. The data was then used to increase our item intelligence creating the need for data retrieval and analysis tools (business intelligence). Analogous to the build-out phase of roads leading to the automotive era, the requirements to stimulate the IoT became low-cost, low-power transmitting sensors, wireless networks with optical bandwidth. Other requirements included location awareness and data warehousing and data visualization. This build-out is well underway creating growth in dozens of companies providing chipsets such as Nvidia (NASDAQ:NVDA), RFID led by Impinj (NASDAQ:PI), data base technology as with Splunk (NASDAQ:SPLK), outsourced warehousing including REITs such as Data Reality (NYSE:DLR), optical components providers as in Oclaro (NASDAQ:OCLR), visualization technology such as Tableau and telecoms moving to LTE.

We now have an acronym-creation race that hasn’t been seen in technology for some time. Internet of Industrial Things “IoIT” (aka Industrial Internet), Internet of People, Internet of Connections, connected (home, car, health, factory, city, anything). Why? Because the cornerstone of the IoT is simple: Sense, transmit, store and use data to improve productivity and generate revenue. The acronyms are because the breadth of the IoT is vast and segments have somewhat different requirements. Goldman was very early on with excellent research on the trends at about the same time Satya was promoted. Many more research reports, articles and analyses of companies can be found by exploring this investor forum which was created as a retrieval cache on this investment theme.

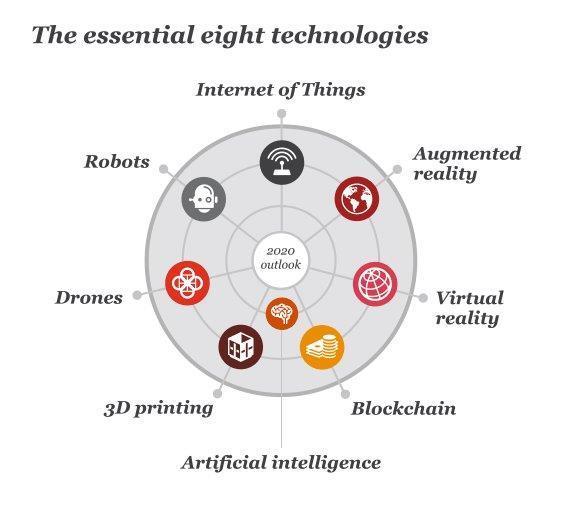

The real opportunity remains ahead of us as this market is still at a nascent stage. The next phase requires several essential technologies and where Microsoft is primarily focusing its efforts along with Apple, Amazon, Facebook (NASDAQ:FB), Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and IBM (NYSE:IBM). These disruptive technologies will empower the IoT for the next decade and impact much more of our lives. PwC listed these eight essential technologies in a research report several years ago. Personally I would have combined a couple and added genetics. For purposes of this article put the IoT in the middle. That presents it as a market opportunity created by these technologies.

The IoT essentials

1. Artificial Intelligence (including Virtual Assistants, Chatbots, Deep Learning, Machine Learning and Big Data) is the primary component. 2017 is going to be the year to watch with respect to AI. Much will be written about the battle of the bots with Alexa/Echo challenging Amazon Home. This battle while important is mostly a consumer acceptance test of AI and Virtual Assistants. Google and Amazon have the most to gain or lose. Already on the Google Q4 2016 conference call, RBC analyst Mark Mahaney pointed out that Google devices were being outsold 10 to 1, leading to concerns about the future of its search advertising core. Amazon has the ability to disrupt a competitor while improving a customer ordering process. It already has a significant network-effect with its retail and Prime business. Owning the Smart Home interface would entrench it even further while simplifying the customer purchase decision even more than its Dot launch. IBM provided an interesting experiment with Watson by creating a movie trailer using AI.

Microsoft AI is focused on its enterprise core competency. You can see tremendous progress in its AI directed toward the Industrial Internet, Connected and Autonomous Car, Connected Cities aka Government. The home market isn’t its priority though it appears to be building an Xbox (Scorpio) platform for HaloLens which will provide computing power for Cortana as its virtual agent.

2. Robots (including drones) provide multiple benefits to the IoT. The primary one is productivity. The more deliveries and actions that can be automated, the greater the productivity gains. Google has invested heavily in robotics acquiring several companies in the process. Consider drones beyond just automated delivery. As costs decline and technology improves, they will likely be used for data transmission of weather patterns or servicing remote locations. Amazon seems primarily focused on drones for delivery efficiency. Little is public about efforts at Apple, Facebook or IBM.

Microsoft is building tools to help others build their own bots or agents with data housed in the cloud reminiscent to operating and application software for desktop computers. It recognizes the requisite core will come from the AI, data intelligence and tools required to create and operate them. Microsoft’s announcements relating to Robots as a Service “RaaS” in Azure.

3. Genetics has the ability to transform healthcare through AI-enhanced bioinformatics. Healthcare transformation is driven by the decline in the cost of genomic sequencing and the movement to personalize medicine. IBM is a serious player with Watson. It is buying medical images to accelerate machine learning, but it’s doubtful it has the development budget to win the long game (see spending table). Bioinformatics combined with genomics has the ability to disrupt our healthcare system. Facebook, Apple and Amazon have published little in this arena. Google has announced some projects and progress but nothing to match the information stream from IBM and Microsoft. AI though is a cornerstone of genetics and deep mind capabilities are not to be ignored.

Microsoft is making a serious investment as well, far beyond the cloud. Cortana Intelligence and Chatbots for voice interface, InnerEye for medical images, Oxford for image analysis, and even HoloAnatomy to assist in surgeries and diagnostics.

4. Blockchain (also known as distributed ledger) is the technology behind cryptocurrencies and smart contracts. This technology appears to be poised to transform our payments infrastructure, specifically with respect to the IoT. Apple, Google and Facebook are viewed as not being particularly supportive of this trend. Recently though Google appears to have embraced it along with IBM and Amazon to support its cloud launch.

Microsoft was aggressive early in this space investing in security and integrated Blockchain as a Service. The fintech section of the forum is still early though useful to see Microsoft progress.

5. Virtual Reality, Augmented Reality and Mixed Reality have so much overlap that it makes sense to include them together. As is the case with all these essentials, AI is the enabling technology. Virtual reality “VR” (immersion) is a simulation while augmented reality “AR” uses VR to enhance our perception of reality. Simplistically consider VR a place to go as an alternative to your surroundings. A virtual classroom instead of a book. Telecommunications rooms with translation agents to replace desktop Skype. Entertainment experiences will drive consumption as hurdles such as nausea are overcome. AR and mixed on the other hand will increase your awareness of reality. Virtual whiteboards will improve business meetings. All the technology group is very invested in this arena. Facebook seems more focused on VR. Apple has been reluctant to share much publicly about its efforts. IBM isn’t particularly visible yet. Google has been public with its Google Glasses launch and now Daydream and Cardboard, but it’s unclear how much is going on behind the scenes.

Microsoft appears to be leading the charge after initially believing it was simply a gaming or consumer technology. Its HaloLens technology for assisted surgery and industrial applications are examples of where this is going. Much more content is available and will be updated on the forum.

6. 3D Printing is a unique disruptor along the lines of robots. Its impact on the IoT is likely to be significant, but it does not appear to be a focus of this technology group. However the disruptive capabilities should not be ignored. If the IoT can use data to ascertain a part or product failure is about to occur, the ability to 3D print it, drone deliver it and robot install it has far-reaching ramifications.

Microsoft has invested in these innovation growth initiatives, however that isn’t all it has done. Promoting an engineer to CEO led to a refocus on productization of development efforts. For many years Microsoft poured money into advanced R&D that seemed reminiscent of the old Xerox PARC Lab where innovation occurred, but was monetized by others. Microsoft has taken years of research into voice recognition, kinetics, artificial intelligence and deep learning and refocused the efforts to build these now essential technologies. A quick recap of how much the group is spending on research and development is also helpful. It provides context for this group. The combined investment required for these essentials is substantial. Microsoft has been able to participate across the board because it has been investing heavily all along despite the drag on earnings. Now when the public awareness of the investment is growing, the actual growth in development expense is not as can be seen here.

A contrarian view on capital allocation and quality of earnings is worth considering. Many critics believe that Microsoft has propped up earnings artificially through both stock compensation and share repurchases funded by a growing debt load. Alternatively consider the shareholder value created by these actions. Buying back shares over the past five years (at substantially lower prices) created economic value to existing shareholders. If the value of a company is worth the present value of future cash flows as both Benjamin Graham and Warren Buffett have argued, decreasing the share count prior to increasing dividends and growing operating cash flows makes each share owned by existing shareholders more valuable. If the stock price had dropped, these concerns would be warranted, but that’s not the case. Buying undervalued stock is a benefit. Having fewer shares to share dividends and future cash flow creates value.

Optics create the impression that earnings are depressed and being propped up by dividing them by a reduced share count. A more compelling view is that earnings are depressed by selling off legacy initiatives that are inconsistent with the current strategic vision. Writing off fixed costs depressed earnings. But now this drag on earnings from numerous missteps has been largely put in the past leading to an opportunity for earnings growth… that will be disproportionately beneficial to investors due to a lower share count. Most retail investors have missed the fact that (led by Microsoft) some technology companies have now stopped adding back stock compensation expense as an adjustment to non-GAAP earnings. Google adopted this approach as of Q4 2016 which contributed to the view that its earnings were disappointing. Investors should be careful to understand this distinction when comparing multiples. Facebook as an example does not embrace this approach which decreases its earnings multiple by roughly 25%. Finally to those that argue that taking on debt has negative ramifications to the company, consider again the alternative view. Microsoft has aggressively locked in long-term debt at the bottom of the interest rate cycle. Companies that have done that despite alternative funding options will seem particularly astute in a few years when inflation drives borrowing and investment interest rates back up.

When Nadella was promoted to CEO, Microsoft immediately served notice. Old technology means a lack of compelling innovation. Shareholders can still benefit through maximized cash flow and dividend payouts, but leads to a lower valuation. Now we see transformative buds that have renewed growth potential. This quarter marks the end of a two-year revenue slide due to the phone business. Adding to that pain were nonproductive expenses and write-offs that further depressed earnings and cash flows. Challenging process but sometimes new growth requires clearing the ground for it. The process has been wonderfully orchestrated and the stage appears set. The questions now become clear. Will Microsoft outpace the competition developing these essential technologies? Will the resultant growth outpace the further declines anticipated in the desktop category? Investment in Microsoft will depend upon your answer to those questions.

Theme investing provides an opportunity to identify a trend that provides sustainable sector tailwinds. In this case, the tailwinds from the IoT and these essential technologies should be long-lasting and stronger than most. There are solid reasons to consider any of the six primary technology innovators highlighted here. Some things to consider are:

Amazon

- Pros: Network effect, Alexa launch, AWS share

- Cons: Valuation

Apple

- Pros: Valuation, balance sheet, brand loyalty

- Cons: Consumer electronics emphasis, capital discipline

- Pros: Network effect, growth rate, monetizable assets

- Cons: Stock option comp, Nanigans metrics slowing

- Pros: Technology powerhouse, monetizable assets, valuation

- Cons: Advertising metrics, shift to voice search, marketing

IBM

- Pros: Watson brand, healthcare focus

- Cons: Legacy business

Microsoft

- Pros: Development breadth, capital discipline, dividend growth, accelerating growth

- Cons: Legacy business

Disclosure: I am/we are long MSFT, GOOG, PI, OCLR, AMZN.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.