My first car had an in-dash 8-track tape player, and in later years I hung on to my walkman and Blackberry for dear life. So I’m trying to not fall too far behind on the Internet of Things – or “IoT” as this next stage in our technological evolution has apparently been dubbed. Everything’s connected or seemingly soon will be, and while I intuitively knew this, seeing the projections from the experts is still eye opening.

While we may not quite reach the 50 billion connected devices by 2020 that Ericsson (NASDAQ: ERIC) and Cisco (NASDAQ: CSCO) predicted several years ago, the move toward greater connectivity is inexorable. According to market intelligence firm IDC, worldwide spending on IoT was estimated at $737 billion in 2016 and will reach $1.29 trillion in 2020.

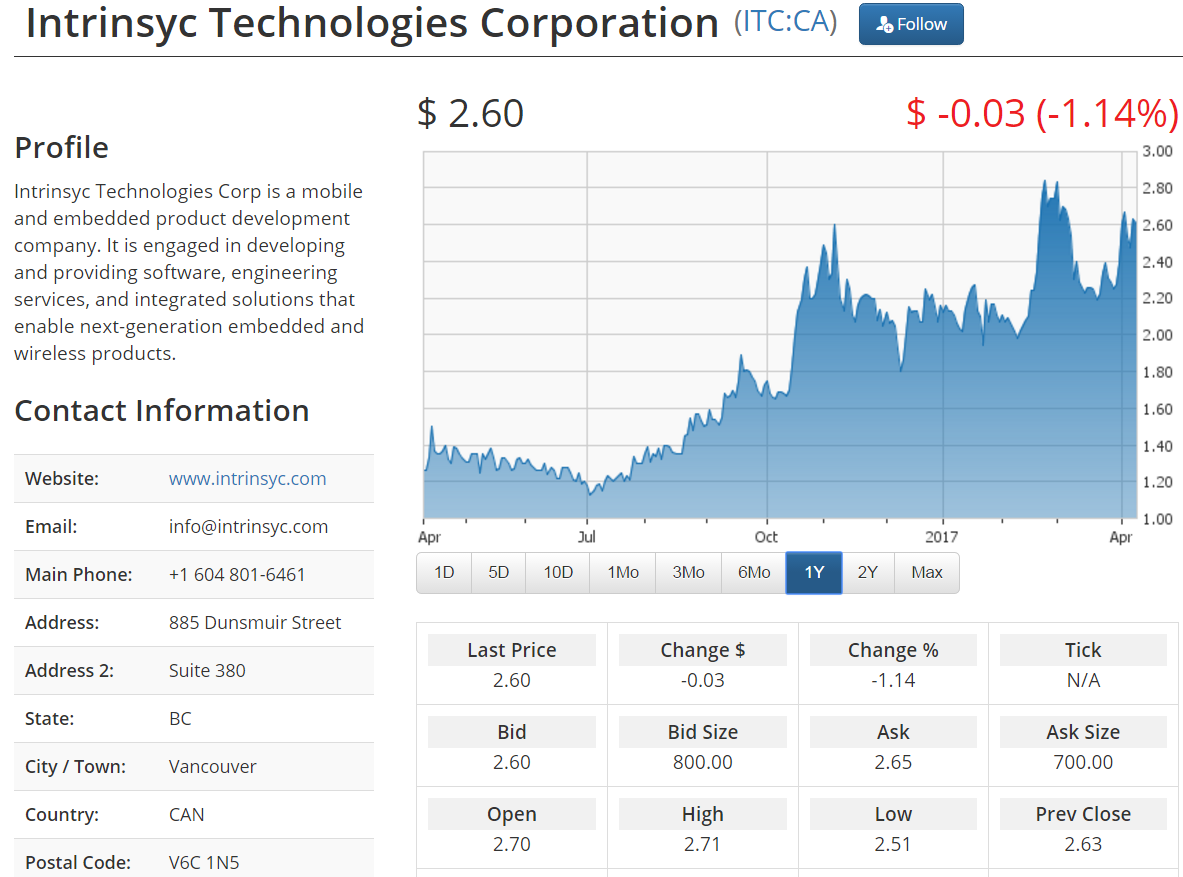

In our focus on the innovation economy, we’ve been following a Toronto Stock Exchange listed company called Intrinsyc Technologies (TSX: ITC) that seems to be very well positioned to ride the IOT wave. (Note that there is a grey market OTC stock here, but we recommend that you stick to the liquid Toronto market if getting involved.)

Intrinsyc provides hardware, software, and design and development engineering services to help device makers and silicon vendors deliver embedded and IoT products with faster time-to-market, as well as improved innovation and quality. Products include: embedded development kits, vertical market reference designs and development platforms, mobile application development platforms, and production-ready embedded computers.

Notably, Intrinsyc is a licensee of Qualcomm (NASDAQ: QCOM) and bases much of its hardware on Qualcomm’s family of Snapdragon processors, the leading mobile chip that powers over one billion devices globally.

Source: Intrinsyc Technologies Investor Presentation, March 2017

The company has posted 45% compound top line growth since 2013 and, in its 2016 annual report, it stated, “In 2017, we expect to deepen our close relationship with Qualcomm; expanding both the programs we support, as well as the technology we license. As a result we will have an increased pace of new product introduction, with several new products planned for launch in the first half of 2017.”

Though the stock has doubled in the past three quarters, it still feels underappreciated at less than C$55 million in market cap (US$41 million) with C$15 million in working capital on the balance sheet. This is a long call on the Internet of Things with the continued global growth in connectivity and the key Qualcomm relationship. We’ll be keeping a close watch on Intrinsyc Technologies.

Please email us at [email protected] if you are a Public Company and would like to see our Testimonials.

Please click here if you would like information on our new trading platform.

Please click here if you’re an investor and would like to see our weekly newsletter.

DISCLOSURE: The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer