Over the past month Alexa, the virtual assistant from the Amazon Echo smart speaker, has forayed far and wide. But, rather than looking at the short-term success of Alexa’s capabilities, let’s look at what this represents for Amazon and Bezos’ strategy for building out the company’s “pillars of longevity”, if you will.

The growth patterns of these pillars are strikingly similar. A simple, unoriginal idea that had been done before, but now taken by Amazon and aggressively pursued until it couldn’t but be successful.

With AWS, it was an idea on paper that was taken and pursued until it became a $10 billion a year business and continues to grow by impressive double digits.

With Prime, it started as free two-day shipping, but is now one of the biggest gateways to Amazon’s hundreds of millions of listed products.

Likewise, Amazon Echo is currently a gateway to Alexa’s success. After having sold between 5 and 6 million units, the Echo line now represents something much more than smart speakers with a voice-based bot answering questions. And it’s because of Alexa.

The reason I call these ideas unoriginal is because they’ve all been done before. Just not that well. And not by Amazon.

The First Pillar of Longevity – AWS

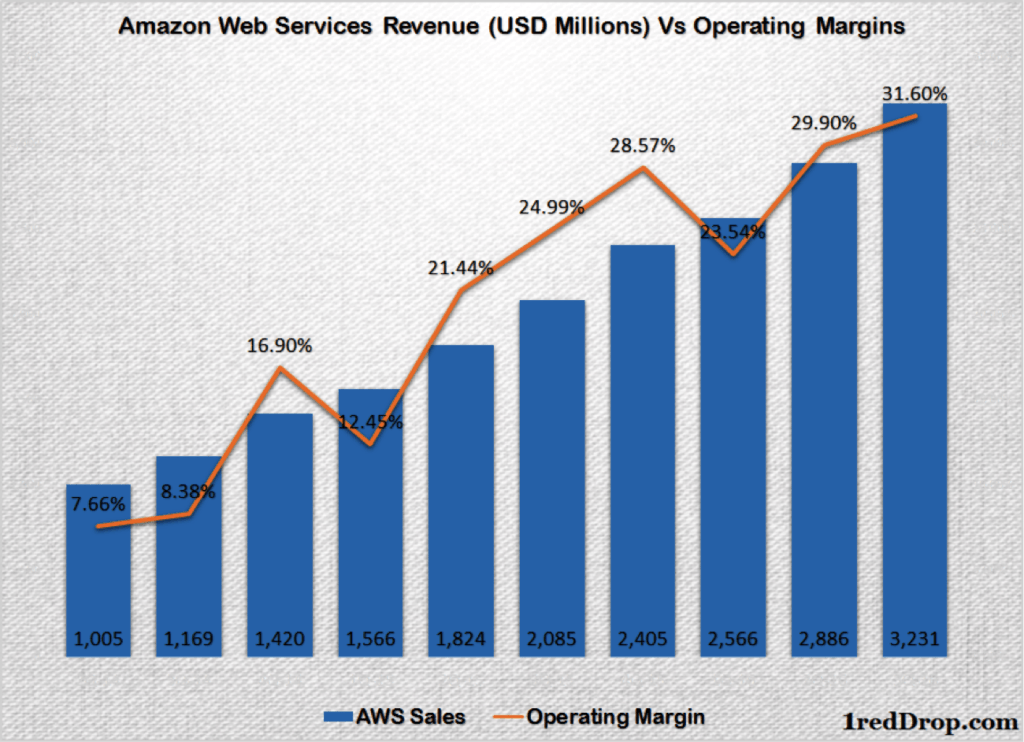

AWS began by offering elastic computing services over the internet, nothing more than an extension of hiring other people’s physical infrastructure for your IT needs. It had been done before, but very soon Amazon’s EC2/S3 became the most widely accessible and accepted cloud computing infrastructure solution in the world…and has stayed that way for over ten years now, getting more profitable each year.

AWS now accounts for the bulk of operating income reported by the company each quarter. In the last reported (PDF) quarter, Q3-2016, Amazon Web Services brought in $3.231 billion in net sales against a consolidated total of $32.714 billion. That’s 10% of overall revenues generated by AWS.

BUT, even though Amazon North American retail brought in $18.874 billion, it only made $255 million in operating income, three time smaller than the $861 million that AWS posted as operating income.

That’s the first pillar because AWS is still growing at a rapid clip and will hold the fort for several years.

The Second Pillar of Longevity – Amazon Prime

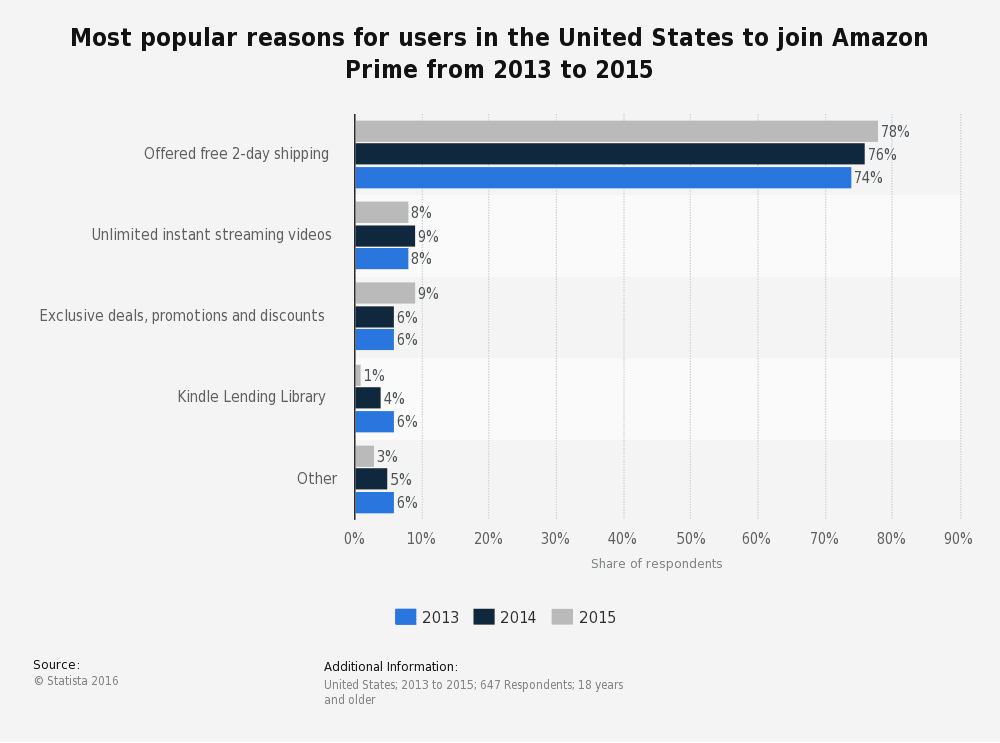

The idea behind Prime is one of the oldest in the book – exclusivity. A loyalty program that offered free shipping for customers who were willing to buy their products online rather than at their nearest superstore. It wasn’t free and it was limited to free two-day shipping when it was first introduced.

But, very soon, it started expanding and actually becoming bloated with value, until today Amazon Prime is one of the world’s most successful and fast-growing loyalty programs for an e-commerce company. Or any company, for that matter.

Interestingly, despite the plethora of benefits, freebies and advantages that a Prime membership brings to a user today, it’s still that very first free two-day shipping offer that brings in the most members every year.

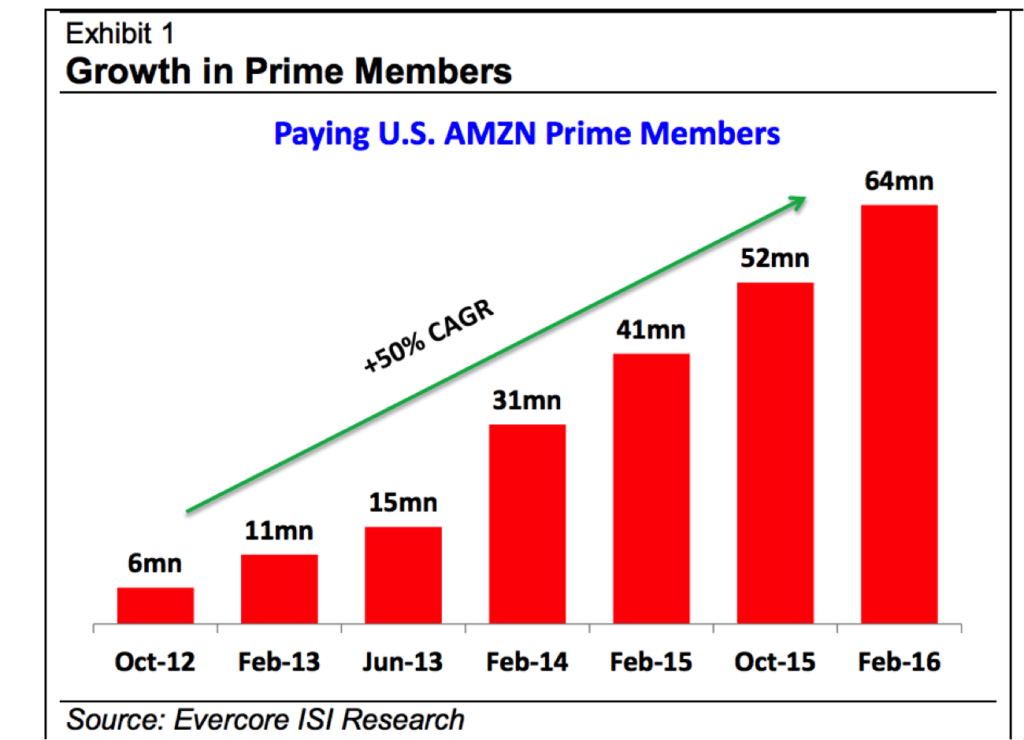

Estimates put Amazon Prime memberships at around the 60 million mark globally at the middle of 2016. After Amazon’s recent successes over the holiday season, that number should have gone up significantly in the United States alone. U.S. membership was estimated at 41 million in July 2016 by the same Morgan Stanley analyst, who also predicts that the global Prime membership base could cross 100 million by 2018.

Evercore estimates show that Prime membership in the U.S. alone is very close to hitting 64 million.

With that kind of fan base, Amazon is gaining more stability with every new market it goes into. They’re only into about a dozen countries so far, and that will probably be the extent of their International reach. They have no need to go into smaller markets where already-wafer-thin retail margins are even skinnier.

But as they enter each market, Prime quickly follows. As with AWS, Prime has several years of growth ahead of it. The stronger it gets, the better for Amazon’s stability as a retail giant.

The Third Pillar of Longevity – Amazon Echo, Alexa or Beyond Both?

Amazon’s Echo line of products did exceedingly well over the past two years, and the most recent estimate on the Echo range’s cumulative sales since launch in 2014 stands at 5.1 million. Again, that was prior to this holiday season’s count so we wouldn’t be surprised if they’re very close to 6 million units sold by now.

Amazon recently reported that Amazon Echo sold 9 times more units during Cyber Weekend 2016 than during the same period in 2015.

But the real pillar of longevity is not going to come from the Amazon Echo or Tap or Dot or any possible future model. It’s going to come from Alexa. The Echo was merely the vehicle that brought the virtual diva into the spotlight.

Going even deeper, it is Alexa’s growing capabilities and skills that will give Amazon their next pillar.

The moment Amazon opened up its APIs for Alexa through the Alexa Skills Kit (ASK) in August 2015, developers and product companies have been looking for ways to use the tech in their own products, or develop new skills for Alexa.

But Amazon didn’t just wave a wand and expect developers to come swarming to them. They actively targeted independent developers, product companies and software start-ups to get them to create more and more useful skills for Alexa. The $100 million Alexa Fund helped, as did partnerships with key industry influencers in television manufacturing (Westinghouse), automobiles (Ford), refrigerators (LG), smartphones (Huawei Mate 9) and others in the sphere of connected products.

Several big companies are integrating the technology with their own products to increase the inherent value of those products; Alexa is continually and abundantly receiving new skills in a crowd-sourced kind of way because it adds value to the average, everyday refrigerator, smartphone, television and car, among other things.

Amazon’s growth will further be fueled by the growth of Alexa, because if Alexa’s going to be on everything, then Amazon will be on everything. Just as Google used Search to get everywhere, Amazon will now use Alexa to go everywhere the virtual voice assistant takes it.

Alexa Everywhere; Amazon Everywhere

In a matter of months Alexa will be making its way into automobiles, home appliances, smartphones and several other consumer-focused products on the market.

But Amazon doesn’t charge for the APIs – they’re free for anyone to come and integrate Alexa with a product. So how does this benefit Amazon’s growth?

We have to remember: the bigger picture here for Amazon is that Alexa will help guide just about everyone back to its master’s retail portal – the part of the business Amazon is really good at.

Why?

Because the Alexa that everyone will be using will already have access to Amazon’s retail catalog by default. Every other skill only goes on top of what’s already there. A company can very well disable and enable the skills it chooses Alexa to have on its own product, but it can’t shut down Alexa’s link back to Amazon retail. In fact, that’s one of the biggest value-additions Alexa brings to the equation in the first place.

That’s also the reason why Alexa will form the next pillar longevity for Amazon. It’s not the Echo as much as the “voice behind the Echo” that will cement Amazon’s position more strongly than ever before in the retail segment.

AWS is the only one of its pillars that doesn’t have parallel connections with the retail part of Amazon’s business, and will probably be the last such silo Amazon builds. All of their current efforts for the future…Alexa integrations, Amazon Go physical stores, drone deliveries with a massive “mothership” fulfillment center hovering 45,000 feet above you…all of that is designed to eventually make Amazon the largest retailer in the world by any yardstick – sales volume, number of products, earnings, profitability, memberships, etc.

Just as AWS and Prime have helped stabilize Amazon as a profitable business and not merely a growing one, Alexa will act as a conduit for voice shopping and a myriad other voice-based services that all point back to revenues for Amazon Technologies Inc.

Of course, this isn’t going to happen overnight. It’ll take at least another few years for Alexa to entrench herself nicely into the consumer durables market segment and yield Amazon the kind of results that AWS and Prime now do.

But the pattern of Alexa’s growth is unmistakable, and that yield will come.

And to think, it all started out with a simple black cylindrical speaker that you could speak to.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.