In the US and much of the world, you have big names like Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), Uber (Private:UBER) and Apple (NASDAQ:AAPL). In China, you have their counterparts that are less known globally: Alibaba (NYSE:BABA), Wechat, Didi, Huawei. Why is that these global companies have a strong foothold everywhere except the second largest economy in the world, China? Further, why is that China has similar replicas, homegrown mirror companies of most major US tech brands?

In global capitalism, throughout the 20th century, US companies were among the first ones to innovate and expand globally. However, a few decades later, in the 21st century, their counterparts parallel emerged in the bedrock of Asia’s core consumer market – which is slowly the world’s largest – China; a country where these firms are sheltered, protected from competition, quasi beefed up by local government programs and connections.

China a few years ago to most Western tech firms meant a lush, desirable and easily enterable market to tap into a billion plus consumer pockets, often considered not developed, not innovative. Today, the landscape has abruptly shifted, not only making most US tech firms struggle in the Middle Kingdom, but to outright leave or fail entering (Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Bloomberg, Uber, Facebook). Nowadays, books emerge, such as Shaun Rein’s End of Copycat China that demonstrate an aggressive giant stepping onto the scene of global capitalism.

It’s not just in tech. According to Quartz, General Motors CEO Rick Wagoner pinned the company’s hopes on expanding in China. In 2003, he said: “We are going to scheme every way we can to do this the most quickly.” Five years later, the company went into bankruptcy.

Billions of customers yet empty profits, toe-to-toe rivalry

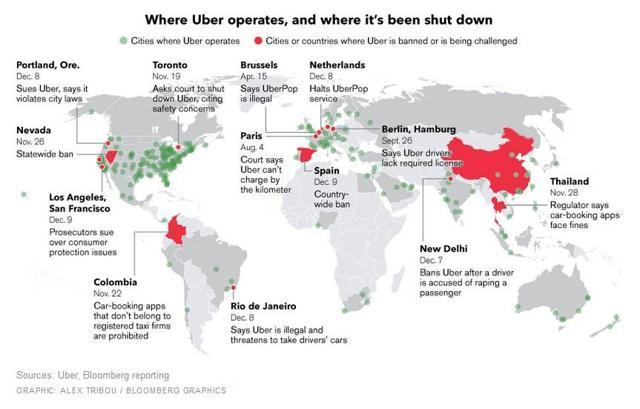

Take Uber for example, a company that symbolizes one of the most galvanizing and market-disrupting business models, perfectly designed for scale: All you need is a mobile phone, credit card and you can book a private ride anywhere within minutes. Billions of dollars in transactions without a single brick and mortar office for the firm. It took Uber merely a few years to change an old industry, a slowly moving, archaic but profitable taxi industry and shake it all up overnight. However, in China it never got a good start. Its main rival Didi had a market share of 80% already back in 2015 summer. By today, it’s over for Uber in China.

TechAsia chart on Chinese ride share market share illustrates the current situation:

Why Uber failed in China and Didi won:

- To be successful in China, you must localize the product, navigate complex regulations, have connections (guanxi) and fend off Chinese “copycats” that are in many cases helped domestically, unfairly. Uber struggled with those from the start -as it’s a software company at core and is easily copied.

- Didi Chuxing, a merger of two of Uber’s Chinese rivals had Baidu (NASDAQ:BIDU) maps from the get go, not Google maps. Chinese people use the local search engine more, and Baidu also has more detailed maps. Maps are the key component of any ride-sharing network and Uber failed to “localize” its offering.

- Uber was a pioneer in other markets, and by the time it entered China, Didi and other local competitors were created, “copying” it. Didi outsmarted Uber by being cheaper on the rides, using registered drivers which Chinese consumers trusted more and allowing options like mini-van or bus rides, creating more choice. Uber simply thought its business model would work in China just as everywhere else.

- Didi, valued at $28 billion in August, let Uber and UberChina unit take 20% of the company (even Baidu owns part of 2.3% stake). Thus, Uber is the largest stakeholder in Didi, but shut off its China operations. Didi invested $1 billion in Uber in return. Didi now controls around 85% of the Chinese market, making any new Western competitions pale in comparison.

- Elite connections needed, with local ties. Didi still hasn’t turned a profit, but is backed by Chinese tech giants Alibaba and Tencent (OTCPK:TCEHY) – both with ties to government funding.

Cities where Uber operates and where it has been shut down

The China El Dorado myth states that globally successful Western companies can grow huge in China without being Chinese. Reality in the tech sector however shows that the “golden city” is just a myth. Customer abundance seduces foreigners, and this astonishing potential opportunity remains what it always was, just potential. Maybe investing in Chinese startups is the best way forward for foreign companies to tap into growth without all the hassle?

From phone manufacturer to phone companies – Apple

Apple is a truly innovative company, or it used to be in 2004 when the iPhone came out. It created a new product category people didn’t know they wanted; a platform that soon will allow it to become a service firm. Nowadays, you have domestic rivals entering the food chain like Huawei and Honor, Xiaomi, Oppo, Baili and Vivo in China that began as budget phones but are moving into the premium category with constant innovation: dual lens cameras, OLED screens, iris recognition, magnetic charging, etc.

According to WSJ, “Huawei’s P9 sports a dual-lens camera and a slimmer profile than the iPhone 6s, while Oppo’s R9 touts the fastest battery charging on the market. Both devices come in luxury colors: gold and rose gold.” Even the new iPhone 7’s main waterproof appeal is something Android devices had since a while.

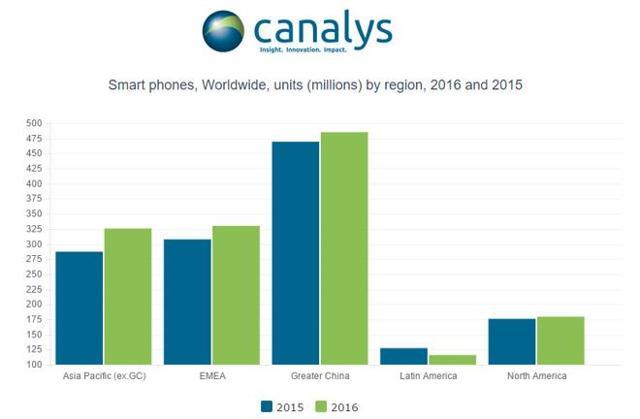

Sales fell 33% to last year in Q2 for Apple in the country, although China is the largest smartphone market in the world, with growth of 3.4% YoY and is the second largest market for Apple after the US. Since Apple generates over 60% of its profits from non-US business, any growth slump can cause problems. Apple is now only the fifth largest phone manufacturer in China from before third place. Will it fall further? These are reasons why it will:

- Growing cyber security threats. Government buyers slash their sales on foreign tech like Apple and outfits phones with local encrypted chips like Gionee M6.

- Patriotic movements, consumers crashing iPhones online – as if iPhone was a symbol of American capitalism or the West’s influence in general.

- New content Regulation: Beijing shut down Apple’s online book and movie services, most likely to slowly prop up its own content and diminish competition.

- Design patent case lost against small Chinese competitor Baili regarding iPhone 6, as Beijing’s IP office ruled against it – interesting in itself since Apple essentially created the smartphone design.

- Trademark dispute relating to use of IPHONE on leather goods. Shutting down of its iTunes Movies and iBooks segments – while China is heavily investing in Hollywood and movie theaters – China’s richest man Wang Jianlin purchased AMC Theaters for $2.6BN.

- Stiff competition. China not cheap anymore: not only are local firms cheaper, they now have the same premium features – Honor from Huawei (Leica double lens cameras) or ultra-low cost competitors like Xiaomi phone which is now a startup unicorn with over a $46BN valuation mainly funded by Chinese (Qiming Ventures) funds.

- Competition not just from Chinese “cheaper” brands but home rivals with new tech such as AI. Amazon’s Alexa, Google Assistant, etc.

Smartphone user numbers are by far the largest in the world in China. Phone shipments have essentially doubled there YoY since 2009, when Xiaomi was created, a company going from a market cap of basically zero to $45BN in a blink of an eye. “Local brands Huawei, Vivo, Oppo and Xiaomi are now the top four smartphone makers in China with a combined market share of 53 percent, according to Counterpoint research director Neil Shah. Oppo almost doubled its market share to 11 percent.”

Before Apple was heavily relying on China to sustain its growth, but in the face of all these new market challenges, it may seem prudent to shift focus into cars and become more service-oriented – building on its iOS community.

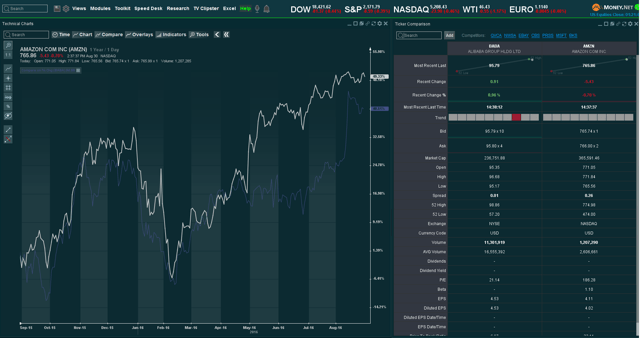

Apple’s latest quarterly report in October showed its first profit slide since 2001. Why? Slowing sales of the flagship iPhones, while brand new cutting edge phones recently emerged: Google Pixel, Xiaomi bezel-less MiMix – newest tech at less than iPhone prices. Warning signs prevail.

In addition, many blame Apple to be playing a catch up game with functions of Android devices (water resistance, double lens cameras), of being out of touch with consumers (Airpod new product no head jack plug in, tweet memes) and being a closed off system (no Android integration of Apple Watch). There needs to be true innovation that outpaces competitors for growth to happen, as China is now not the copycat economy it once was.

E-commerce the Chinese way – domestic stronghold first

Alibaba is another example of how a Chinese domestic firm has grown up in the shadows of its American mirror rival, Amazon. While Amazon began in 1994, Alibaba (The Amazon of the East) was founded in 1999. Alibaba twisted the pure online retailer strategy and acts more as a middleman between buyers and sellers like eBay (NASDAQ:EBAY), providing everything in between: payments (Alipay), TaoBao online mall and Tmall for larger retailers, maps, comparison shopping (eTao), cloud computing (Aliyun), instant messaging, music service (Xiami), crowd sourcing translation service (365fanyi), healthcare, micro lending and the list goes on with new acquisitions.

From Prime Day of Amazon came Singles day by Alibaba. It is publicly listed both in the US and China, and is similar in certain areas to Amazon but ultimately differs in the economies they serve, vision and business model.

- Amazon did not post a profit last year yet the stock price was up 57%. Alibaba turned a $5.5B profit, yet its stock price was down 3%. Certain bias to Chinese remains from Western investors.

- P/E ratio is wildly different and should make Alibaba more favorable for investment, as Alibaba is 21 while Amazon is 186 (P/E industry average is 42), although BABA had sky-high expectations since its IPO, however failed to meet them.

- While Alibaba dominates its Chinese domestic market, Amazon’s focus on the world is paying off, India being a new market that is growing. Amazon is a true global player, Alibaba is still reliant on the “home turf.”

- Alibaba’s 5.6% stake in Groupon (NASDAQ:GRPN) signifies a step to bring services to Western consumers, to expand. It can also lead to a lot more acquisitions, which seems to be the new theme for cash rich Chinese tech firms with global ambitions.

- Amazon’s business is not doing good in China; it even opened a store on Alibaba’s Tmall site. Its losses are estimated to be $600M a year in China, and only accounts for 1.5% of China’s e-commerce, since its prices are generally higher than Alibaba’s.

- Alibaba recently announced an investment in Amblin, and tapping into Hollywood by partnering with Spielberg. The Chinese e-commerce site’s knowledge of Chinese consumers and data will in turn allow Amblin to expand Hollywood movies into China.

(Source: Money.Net terminal charts)

Innovation, globalization at the moment is tilted more in Amazon’s favor, with Amazon Echo moving into home products, Amazon Flex a delivery service similar to Uber, own clothing range and a slew of branded products (Kindle) to name a few. While Amazon is well positioned to grow with global internet penetration and more consumers globally, Alibaba needs to start its foray out of China, where it already established a strong presence.

Curious investment scenario – Western firms lose China

According to the Brookings Institution, “China is unusual in that it is a developing country that has emerged as a major investor.” Investing in foreign tech to make it local tech seems to be the current scenario, making all pioneering Western firms lose out in the domestic regulatory-price-tech wars.

First, it’s not just tech where more competition is coming daily, where companies innovate at the speed of light. In other more traditional, industrial segments: For example, China recently launched a competitor Aero Engine Corp. (96k employees, $7.5B funding) to GE’s (NYSE:GE) most profitable division, commercial jet engine manufacturing. If such high know-how and prestigious industries fall to Chinese price competition, what won’t?

Secondly, it’s not just Western firms that are facing unique governmental, competitive, local competition from domestic bred and fed Chinese firms. A recent Wall Street Journal article foreshadows the end of Hong Kong’s independence as we know it, portraying the demise of its own firms’ competitiveness due to hungry Chinese newcomers and political changes harbingered by Beijing there.

One of the ways China outpaces competition is by technology transfers, mandating VCs like the many car manufacturing agreements: They let Western firms into the domestic market (SAIC, Volkswagen, Audi) and co-produce products using Western technology, slowly learning from them and then creating back door competitors on the home turf. These firms then push out the original Western firms after they reach a level of sophistication. Again, Uber is a perfect example.

In summary, investments should focus on those tech companies that can create dominance globally, having a strong foothold in multiple key markets even if their Chinese presence falters. Companies that in a way encircle these new Chinese entrants, threats and don’t leave much chance for them to become truly competitive globally.

This will enable these firms to hinder the growth of any Chinese firm in the local phase of taking tech and funds within China. The local advantage, the Chinese government, regulations, connections and brand recognition won’t be there to help them when these Chinese firms try to cross the borders to seek global dominance.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.