This Could Send CSCO Stock Higher

Traders are often jittery and impatient by nature. Sometimes the best things in life are worth waiting for, which seems to be the case with Cisco Systems, Inc. (NASDAQ:CSCO) stock.

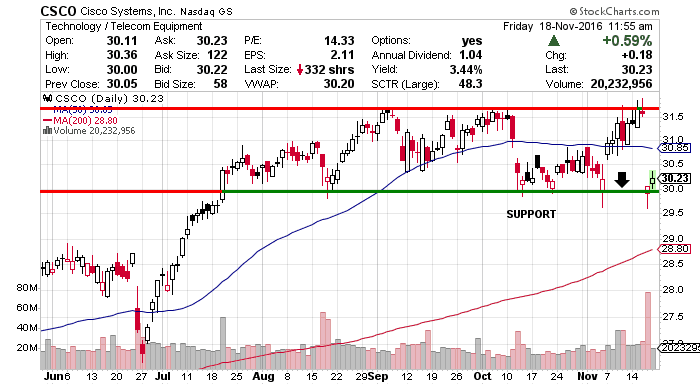

Yet CSCO stock fell six percent last Thursday to south of the psychological $30.00 threshold that I view as an opportunity and not a sign to run, especially if Cisco stock heads lower toward its 52-week low at $22.36 in February.

What you have to understand is that Cisco Systems is undergoing a major structural transition with CEO Chuck Robbins, who has been on the job only since July 2015.

And just like Satya Nadella at Microsoft Corporation (NASDAQ:MSFT), and even John Chen at BlackBerry Ltd (NASDAQ:BBRY), one has to give Robbins some time.

The thing is that Cisco is in transformation mode, moving from depending on its networking legacy business to solutions for the Internet of Things (IoT), including mobile, big data, cloud computing, optical, and security.

Chart courtesy of Stockcharts.com

Now, the process could be long and arduous, but companies the size of Cisco Systems have both time and capital behind them.

The fiscal first quarter saw Cisco Systems report a flat one percent rise in revenues and a $0.02 beat in adjusted earnings.

The results were mixed, with good growth in its security business, but this was offset by a small decline in revenues from two other key growth areas: “Collaboration and Data Center” and “Wireless and Service Provider Video.”

Cisco Systems also offered up a soft fiscal second quarter outlook that clearly left investors of CSCO stock on edge.

But there is still hope for investors in CSCO stock.

Cisco Systems will likely benefit from Donald Trump’s ascension to the White House, if you believe what he has suggested. Trump wants to encourage U.S. companies to repatriate profits back home, via the use of lower taxes.

If this happens, Cisco Systems could bring back tons of cash and use it to further develop its transition, along with potential acquisitions. The company could also use the cash to buy back CSCO stock and raise its dividends, which are both price-supportive.

Yet the bottom line is that Cisco Systems will need to be ultimately successful in its transition to the growth areas, or CSCO stock could drift for years.

At its current price, Cisco stock is not expensive, with a price/earnings to growth (PEG) ratio of 1.37 and 2.40 times its book value. This attractive valuation of CSCO stock will allow time for Robbins to transform the company into a new technology play.

Hi, George Leong here. If you enjoyed this article, you can get more of my opinions and commentaries in our popular daily tech letter, Profit Confidential. Published daily, it’s FREE! Join us when you click here now.