Cisco (NASDAQ:CSCO) is the reference for switches and routers across the world. The way we transfer data throughout networks has been a pillar for many industries over the past decade. While 2/3 of CSCO revenue comes from switches and routers, the rest of CSCO sales are coming from faster-growing adjacent market segments such as wireless, security, collaboration, unified communications, and data center products.

While the LAN/WAN equipment market is mature and doesn’t show much growth opportunities, the Internet of Things (IoT) is opening the doors wide open to Cisco for another decade of strong growth. I believe this opportunity has not been completely factored in CSCO’s price and you can still enter into a position in this tech giant.

What Makes Cisco a Good Business?

As Cisco is the undisputed leader in its industry, this is also the player that sets the standards for others. In fact, we can say that Cisco is the gold standard in Ethernet switches and routers. This enable CSCO to benefit from a stronger premium on all its products and services. As many companies are dependent on their networking system to operate on a daily basis, their switching costs to ditch CSCO is enormous. The expertise gained by their network engineer across all type of businesses keeps CSCO one step ahead of its competitors. Cisco has built and protected a very strong niche here.

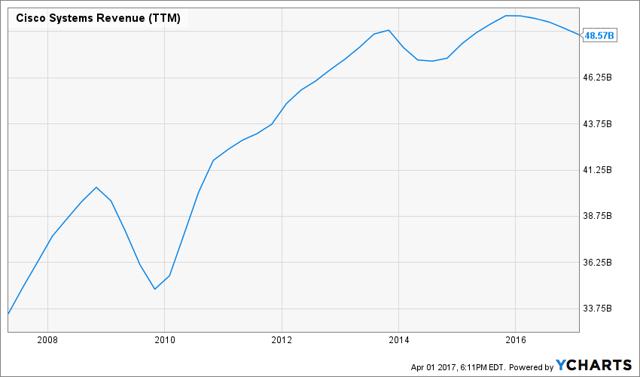

Revenue

Revenue Graph from Ycharts

After going through an impressive growth in the first decade of the 2000s (revenues were up +132% from January 1st 2000 to December 31st, 2009), the company’s revenue has stagnated over the past three years. As their main sources of revenues are coming from switches and router equipment and services, there isn’t much growth there. However, there is more to discover when you dig further.

How CSCO fares vs. My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income-seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple. When a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

CSCO’s dividend yield has grown up from 3%-3.50% over the past 12 months. While the company’s dividend history hasn’t been around for a decade yet, management seems to be in line to reward their shareholders with a solid yield in the years to come. From April 1st 2013 to March 31st 2017, the stock price went up by 61.76%. Nevertheless, the yield has continued to go higher as the company showed a strong dividend growth policy.

CSCO meets my 1stinvesting principles.

Principle#2: Focus On Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

Cisco is a “young” dividend growth payer with *only* 6 years of consecutive increases. However, since management has started this new tradition, they seem quite committed to increase their payout each year. In the past 5 years, the company grew its dividend payment from $0.075 per share to $0.29 in 2017.

CSCO meets my 2ndinvesting principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

Source: data from Ycharts.

It’s one thing to show a strong double-digit dividend growth over the past 5 years, it’s another to keep it going in the future. Don’t be blinded by the stellar dividend growth starts of Cisco. Management will definitely put a brake to the double-digit growth rate at one point or another. However, with a cash payout ratio of 42.55% and a payout ratio of 53.18%, you can expect strong single-digit growth rate for several years to come.

CSCO meets my 3rdinvesting principle.

Principle #4: The Business Model Ensures Future Growth

The core business model of Cisco will continue to generate a steady cash flow for many years to come. While the switches and routers business has matured, most companies will continue to depend on Cisco technology and expertise to operate their business. The switching cost would be too high for them and CSCO continues to invest massively in R&D to support their clients with the best-of-class technology.

As the core business is solid, Cisco can now concentrate on faster growth vectors such as the integration of IoT for many businesses. As cited by Cisco’s website, the company can help businesses entering in this new era of communication:

“Traditionally, IT and operations work in silos. IT handles the “computer stuff.” Operations drives production on the manufacturing floor. IoT represents a merging of these two disciplines, calling for a powerful network of devices that can be utilized by operators on the floor. Factory floors have traditionally been connected through proprietary, vendor-specific networks that can’t handle the complexity of the IoT. The lack of a standard, open network restricts IoT initiatives and constrains business growth, effectively cutting you off from the benefits of the IoT.” (Source:Cisco)

CSCO still shows a strong business model and meets my 4thinvesting principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its P/E ratio:

Source: data from Ycharts.

It is hard to make my mind up when I look at this graph. CSCO’s multiple is going from anywhere near 11 to as high as 28.75. Not to mention the various highs and lows during the last decade. After being traded around 13-14 for a year, the company’s P/E ratio suddenly bounced back to 17.42. This is mainly because their latest earnings was 24% less than last year same quarter. Nonetheless, the stock price has risen over nearly 12% for the first quarter of the year. This tells you the market believes in Cisco no matter what the short-term results are.

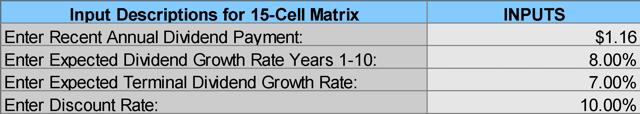

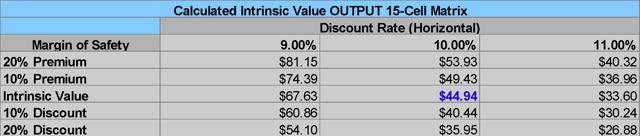

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I’d rather see companies like a big money making machine and assess their value as such. Even though management increased their payout by 12% in 2017, I will use a first 10-year growth rate of 8% and reduce it to 7% for my terminal rate.

I’d rather keep numbers more conservative. Normally, I would use a discount rate of 9% for a company that is a world leader in a mature business. However, since Cisco evolves in the technology sector and the wind can turn around on a dime, I will be more cautious and use a discount rate of 10%.

Here are the details of my calculations:

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

CSCO meets my 5thinvesting principle with a potential upside of 33%

Principle #6: The Rationale Used To Buy Is Also Used To Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

An investment in Cisco is an investment in the future. You can solidify your portfolio with a solid dividend payment of 3% and count on a strong single-digit growth for the years to come. Because of its solid relationships with their multiple clients, CSCO is in a premium position to offer them IoT services.

Cisco has the size and cash to follow their clients and answer their future needs. It can then continue to benefit from the strong bond it has established with its clients and offer further products to expand its revenues.

CSCO shows a solid investment thesis and meets my 6thinvesting principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: The core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segments helps me to categorize my investments into a “conservative” or “core” section or into a “growth” section. I then know exactly what to expect from it; a steady dividend payment or higher fluctuations with a greater growth potential.

Even if CSCO shows a strong growth potential for the next decade, I would rather place this company in a core portfolio. We are still hoping Cisco will transform its business model and will go on a strong growth uptrend like Microsoft (NASDAQ:MSFT) did with the cloud business. However, as management expects -2% to 0% revenue growth for Q3, we are far from a rocket here.

CSCO is a core holding.

Final Thoughts on CSCO – Buy, Hold or Sell?

In the light of this analysis, it has become clear CSCO is a strong buy. At worst, you are buying a company with a solid dividend yield with enough room to increase it for more than a decade. At best, you are buying a company that is about to grow strong in a new market of the Internet of Things.

Disclaimer: I do not hold CSCO in my DividendStocksRock portfolios but intend to purchase the stock.

The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Additional disclosure: If you like my analysis, click on FOLLOW at the top of the article near my name. That will allow my articles to display on your homepage as they are published.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CSCO over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.