Bull runs have historically been thwarted during the fall only to reverse through the holiday season. This year there are several stocks that have outperformed the market and the typical selling that occurs in the fall could provide great opportunities for investors. The impressive bull run that has been dominating after the reversal of BREXIT selling seems to be due for some pull back. A look at the (NYSEARCA:SPY) reveals that over the past few years, fall selling is more probable when markets are at all time highs in the third quarter. Below we can see that in 2014 and in 2015, when stocks were at all time highs going into the fall season, stocks pulled back 6% and 9% respectively. If the past is any indication of the future, we can expect a fall pull back within that range, which would bring the SPY into the range of 198-204. If this were to occur huge opportunities will become available.

Source: TradingView

One company that has been outperforming, reaching 52 week highs is Cisco Systems (NASDAQ:CSCO). As Cisco becomes a leaner company by reducing costs, it will continue its growth trend higher, creating value for investors. In 2016 Cisco has been able to increase revenues and reduce operating margin as they phase out legacy businesses of switching and routing. This is exciting news for investors because the company has been able to increase revenues as a whole while shifting away from old business that is becoming less profitable and outdated due to a shift towards the cloud.

According to the latest earnings call, Cisco’s new focus is on providing subscription-based software to capture recurring revenue. In a world where the momentum is shifting toward the cloud and the “internet of things” (IoT), Cisco is on the forefront to lead the next internet generation. Outdated hardware such as routers and switches are no longer the focus and Cisco has the vision to invest in its future business. Being one of the major software providers, Cisco offers customers the opportunity to get ahead of the movement into the cloud and Internet of Things. For Cisco, these services generate recurring revenue due to licensing and this past year alone, sales have increase by 33% in software and subscriptions while routing and switching both declined.

Cisco is helping industries and cities speed up their IoT adoption and by 2030, it is expected that 500 billion devices and objects will be connected to the internet. Cisco has already been able to boost efficiency and growth for customers and the adoption to IoT is still in its early stages. Cisco provides insights and analytics on IoT data along with data protection for customers that adopt IoT with Cisco. Cisco’s involvement in the broad adoption of IoT is the infrastructure that connects objects and devices. Customers can work with Cisco on a licensed based software product subscription to maintain and analyze their connectivity.

Cisco has been outperforming primarily due to the excitement generated by their integration to the cloud and internet of things. The stock is trading just off its 52 week highs and 10 year highs. Cisco has been performing as a value stock over those 10 years, and is currently yielding 3.3% at its price of $31.34. With the new focus on integrating the cloud and internet of things, Cisco is primed to become a growth stock in the latter part of this decade. There is a lot of potential with Cisco today and there are few risks to the downside. At the current price the stock has a 3.3% yield and 14 future PE ratio. Investors can start layering in to gain income while holding to generate capital gains in the short and long term.

Using Cisco’s latest financials we can see that during the last fiscal year as routing and switching declined in sales, Cisco managed to increase total sales by 8% due to the large growth in software subscriptions. By licensing software and selling subscriptions that expire, Cisco is more likely to have recurring sales through renewals with retained customers. Therefore, even a growth rate of 33% for software subscriptions could be low as more customers adopt IoT and as the cloud becomes more mainstream. However if we assume another increase of 33%, extrapolated from their financials, in software subscriptions sales, and expect routing and switching to continue to decline at 2%, total sales will continue to grow between 6-9% in the short to midterm. For FY2017, this would increase total sales to $53B, and at a 30.7% contribution margin, that would result in earnings per share of $2.53. At the current PE ratio of 14, my expectation for the stock price is $35.45. This represents about an 18% increase in the stock which is primarily driven by Cisco’s participation in the adoption of the Internet of Things.

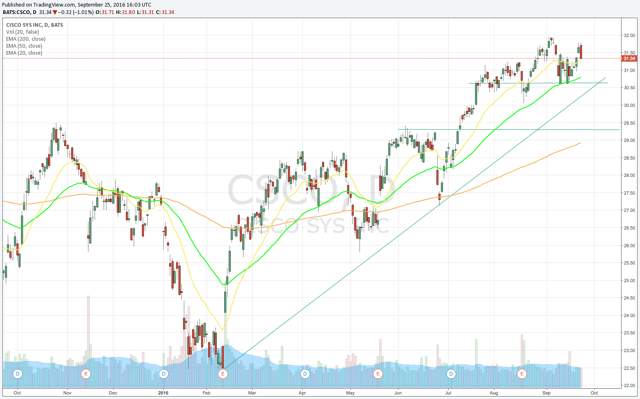

As discussed, the overall market is trading just off all time highs as it enters the fall trading season. History indicates that investors should tread carefully as a short term sell off may be just around the corner before a strong holiday season. As we can see below, Cisco’s stock falls into this same category. It has been a very strong stock in 2016, but it has also found itself trading above short and long term moving averages, that could indicate a short term pull back would be healthy. Below we can see short term support at $30.6 and long term support at $29.3. This is supported by previous resistance points and pivots that were taken out as well as the 50 day and 200 day moving averages. Interestingly, this price represents a pull back in the range we discussed that is typical of selling that occurs in the fall.

Source: TradingView

It is likely and probable the market is due for a fall correction that will scare investors into selling stocks down 6-9%. If this sell off occurs, I would be very excited as many opportunities will become available. Stocks have been performing well since BREXIT and as much as I don’t think a full on bear market is around the corner, I do believe a healthy short term pull back is inevitable. If we put any value into historic events, there is no better time than now for stocks to sell off as we head into the fall. Cisco is one of many companies investors should be excited to be in, and if it goes on sale for more than 5%, there is no reason to hold back.

Disclosure: I am/we are long CSCO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.