Investment Summary: Acorn Energy is poised for strong growth with the divestiture of their interest in their DSIT subsidiary and there renewed focus on the fast growing internet of things via their Omnimetrix business. Additionally from a valuation perspective, Acorn Energy appears substantially undervalued relative to their peer set.

Summary: Acorn Energy (NASDAQ:ACFN) was founded in 1986 and is a technology solution company that focuses on two major business divisions. The two business divisions are Energy and Security Sonar Solutions, and Machine to Machine Critical Asset Monitoring and Control. The Energy and Security Sonar Solutions is by far the most profitable division for Acorn. The Energy and Security Sonar Solutions also known as DSIT provides sonar and acoustic solutions for energy and defense. Machine-to-Machine also was known as OmniMetrix is real-time machine information that gives users real-time visibility of their equipment and assets.

Brief Company Description: Acorn Energy is headquartered in Wilmington Delaware and was also incorporated in Delaware. Acorn Energy focuses on technology driven solutions for energy infrastructure asset management. With the recent partnership with Rafael Advanced Defense Systems, Acorn Energy consolidated their subsidiaries down to one major subsidiary. The final subsidiary is OmniMetrix which provides user remote diagnostics and prognostics for their equipment and assets. OmniMetrix offers two segments which are Power Generation and Corrosion Protection. Power Generation is a wireless remote monitoring and controls a system which allows users to services their assets through Internet of Things applications. Corrosion Protection provides remote monitoring of cathodic protection systems in gas pipelines for gas utilities and pipeline companies. Acorn Energy could easily be an acquisition target for another larger Internet of Things developers looking to diversify their product portfolio.

Key Investment Points: Acorn Energy has started to make changes in order to better their business model and their company. For these reasons, we feel that the company has a strong outlook in the future. With lower the interest in DSIT, they are able to continue operations as a company, as well as lower costs. With the freed up capital, Acorn Energy can focus on the OmniMetrix. We feel that Machine-to-Machine is the future with the advancement of technology. This division has the most growth potential in the coming years for Acorn Energy.

- Recently partnership with Rafael Advanced Defense Systems for the DSIT subsidiary. This partnership lowers Acorn Energy’s interest in DSIT from 78.7% to 41.2%. Acorn Energy received $4.9 million from this sale prior to escrow and taxes.

- Ceased operations of its GridSense subsidiary in the third quarter and sold off assets to Franklin Fueling Systems. Acorn Energy sold the assets for a gross sales price of $1 million. This subsidiary was operating at loss in 2015 and during the first nine months of 2016.

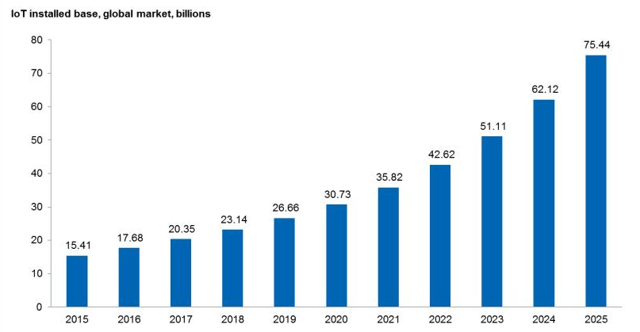

- Recent consolidation frees up capital for the OmniMetrix subsidiary. OmniMetrix has a strong outlook due to its involvement with the Internet of Things. Internet of Things is expected to grow to a $75 billion industry by 2025

Last Quarterly Financial Summary: On November 14, 2016, Acorn Energy released their third quarter results for 2016. This quarter was significant for their overall business model. Acorn Energy decided to cease operations for one of their major division and sold off a major part of a different division. The consolidation of Acorn will provide value in coming months and coming years.

Acorn Energy sold their GridSense subsidiary to Franklin Electric Co. on July 12, 2016. Acorn Energy sold this subsidiary for $1 million in gross price. GridSense was a division that focused on developing remote monitoring systems for electric utility companies. This division made $2.5 million in revenue for 2015. The major issue with this division was that it was still operating at a loss. This deal provided the best outcome for Acorn Energy since the software that they developed will still be used while also getting rid of a division eating away at margins.

The other major division change that occurred in the third quarter of 2016 is the DSIT division. Acorn Energy received $4.9 million for half of its 79% fully diluted ownership. They state that the reason behind this decision is because Rafael Advanced Defense Systems has a stronger global reach. With the partnership, Acorn is hopeful that the partnership will significantly enhance the potential of DSIT. Acorn Energy’s management still has a significant interest in DSIT with approximately 9% interest in DSIT. The de-risking of Acorn will provide capital for growth with OmniMetrix division.

Source: Israel Ministry of Defense

Rafael Advanced Defense Systems: Rafael Advanced Defense Systems is an Israeli defense company that recently bought a majority of Acorn Energy’s DSIT division. Rafael specializes in developing commercial technologies based on defense technologies. With more capital available to Rafael when compared to Acorn Energy there are major growth opportunities for this DSIT division. While still having a stake in DSIT, there are major growth opportunities still for Acorn Energy even though they do not have the majority stake in DSIT. In 2014 Rafael had over $1.9 billion in sales, which is significantly more than Acorn sales and outreach, so DSIT will have the ability to make a bigger impact on the commercial market.

Since the original sale to Rafael, there has already been success for DSIT. In June DSIT had an order of $7.1 million for its Blackfish Hull Mounted Sonar system. In the first 9 months of 2016 DSIT generated $11.9 million in revenue and $5.1 of that revenue was from the major sale transaction. Gross profit and operating income both improved in 2016 and this is mainly because of the partnership with Rafael Advanced Defense Systems.

Internet of Things Growth: With the recent sale of their division, Acorn Energy is betting that their OmniMetrix subsidiary will be the main growth driver in coming years. We feel that is the best decision for Acorn in the coming years. Their OmniMetrix is a leader and pioneer in machine-to-machine monitoring. The Internet of Things plays a major role in machine-to-machine monitoring. The Internet of Things is the interconnectivity of physical devices to other physical devices in order to share data and other information. The Internet of Things has been growing rapid in past years and is expected to grow even more in coming years. This is one of the main reasons why we believe that OmniMetrix is right choice for Acorn Energy in the coming years.

There are many industries that use the OmniMetrix but currently, some of the major industries are data centers, pipelines, and hospitals. The OmniMetrix allows companies to remotely monitor key components of their business to catch problems before they occur. This technology is pivotal in the expansion of remote technology since it allows users to maintain a flowing work environment with limited risk. With the recent partnership withRafael Advanced Defense Systems,we believe that the OmniMetrix could be a future target for acquisition. Rafael Advanced Defense Systems has many different subsidiaries and cannot afford failure in of any other their systems. For this reason, we believe OmniMetrix could be the next acquisition target for Rafael in order limit failure.

Source: IHS Markit

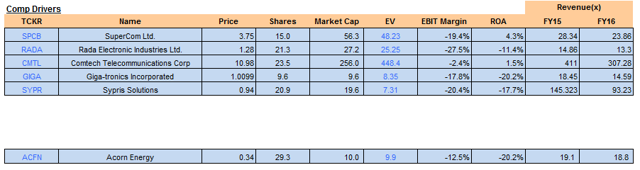

Comparable Company Analysis: In order to value Acorn Energy, we did a comparable company analysis. We decided to compare Acorn Energy to SuperCom (NASDAQ:SPCB), Rada Electronic Industries (NASDAQ:RADA), Comtech Telecommunications Corp (NASDAQ:CMTL), Giga-Tronics Incorporated (NASDAQ:GIGA) and Sypris Solutions (NASDAQ:SYPR). When deciding these companies we looked at small market cap defense solutions companies. SuperCom and Rada are Israeli companies who focus on military and commercial markets which are similar to Acorn Energy’s partner Rafael Advanced Defense Systems. Comtech and Giga-Tronics are both communications company’s whose main products are for military and commercial markets. Sypris Solutions is an aerospace and defense company who main customers are the trucking and oil and gas industries. The comparable company analysis demonstrates that Acorn Energy has a valuation of $0.53 based on EV/Multiples using the companies based above.

Source: JGR Capital Partner’s Analysis

Key Risk Factors: Company has a history of operating losses and will likely need additional cash to pursue acquisitions. Additionally, there is a limited trading market for this stock and because of this price movements will likely be volatile. For a full list of risk factors, investors can download the company 10-K filing.

Conclusion: Overall Acorn Energy looks a viable high risk high reward investment opportunity. The energy infrastructure market is a high growth industry and Acorn Energy seems attractively valued relative to comparable companies. Additionally, Acorn Energy is competitively positioning itself within the enormous internet of things market. For the aformentioned reasons we believe Acorn Energy is an interesting high risk high reward investment within a diversified portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.