The Internet of Things (IoT), the connection of various objects to “the cloud” and to each other, is one of the hottest growth markets in the tech sector today. Cisco (NASDAQ:CSCO) predicts that the number of connected devices worldwide will double from 25 billion in 2015 to 50 billion in 2025. IDC expects the market to grow from $655.8 million in 2014 to $1.7 trillion in 2020.

Those bullish expectations have inflated the valuations of many IoT-related stocks, making it hard to find “cheap” plays on this growing market. So today, I’ll introduce two companies that will profit from the growth of the IoT market but still trade with fairly low P/E ratios below 15.

Image source: Getty Images.

Juniper Networks

Juniper Networks‘ (NYSE:JNPR) networking hardware and software connect IoT devices to each other, but it’s often overshadowed by larger rival Cisco. IDC says Cisco controlled 56.8% of the global ethernet switching market in the second quarter this year. Juniper only controlled a single-digit share of that market, but it’s much stronger in the combined service provider and routers market, where it held a 15.7% share against Cisco’s 44.8%.

Juniper’s revenue rose 5% last year, and is expected to rise 1% this year and 4% next year. Cisco’s sales, which stayed flat last year, are expected to grow 1% this year and 3% next year. Near-term headwinds, like slower enterprise spending, are throttling both companies’ top-line growth. But looking ahead, the growth of the IoT and new 5G networks should still fuel their long-term growth.

Cisco, HPE, Huawei, and Arista Networks are all tough rivals, but Juniper has been widening its moat by acquiring other companies and securing big contracts. To strengthen its service provider business, Juniper acquired cloud and metro networking provider BTI Systems earlier this year. It also agreed to buy Aurrion, a developer of silicon photonics technology which reduces the costs of its networking systems. Last month, British Airways chose Juniper to expand its cloud and core networks.

Juniper’s earnings rose 40% in 2015, but soft router and security sales are expected to cause earnings to fall 2% this year. After those businesses stabilize, growth is expected to return with a 9% rebound next year. Both Juniper and Cisco trade at 14 times earnings, which is much lower than the industry average of 25 for networking equipment companies.

Silver Spring Networks

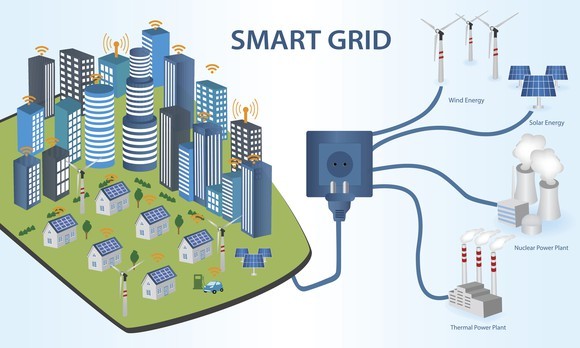

Silver Spring Networks (NYSE:SSNI) sells “smart grid” products that transmit data between electric meters, EV charging stations, smart thermostats, and in-house displays to run smart cities. Its top customers include major utility companies like Consolidated Edison (NYSE:ED), Pacific Power, and American Municipal Power.

Image source: Getty Images.

Research firm Markets and Markets believes that the smart-cities market will grow from $312 billion to $758 billion between 2015 and 2020. Silver Springs’ sales surged 47% in 2015. Silver Springs’ top line is expected to grow 7% in 2016, then accelerate to 13% growth in 2017. Last quarter, Silver Spring reported that its number of cumulative network endpoints had risen 13% annually to 24.3 million.

To expand its margins, Silver Spring is pivoting toward cloud-based services to reduce the amount of hardware that needs to be installed across its smart grids. That shift, along with its expanding scale, helped it post a full-year profit in 2015 following several years of annual losses. The company expects sales to accelerate in the second half of the year, and analysts expect its earnings to grow 67% this year and another 93% in fiscal 2017.

Those growth estimates look robust, but Silver Spring trades at just 10 times earnings and the stock has fallen about 5% this year. There’s not a simple explanation for this lack of investor interest, but it’s likely due to the fact that it’s a small-cap stock and concerns that it might be marginalized by larger grid rivals like General Electric and Cisco. But then again, its low enterprise value of $600 million, low valuation, clean balance sheet, and well-established customer base make it a lucrative buyout target for those larger players. However, buying a stock based on the possibility of a buyout would not be wise.

The bottom line

Investors shouldn’t simply buy a stock because it has a low P/E. But in a high-growth industry like the Internet of Things, screening for stocks with multiples that are below industry averages can help you find overlooked stocks like Juniper and Silver Spring, which both deserve a closer look from value investors.

Leo Sun owns shares of Cisco Systems. The Motley Fool owns shares of and recommends Arista Networks. The Motley Fool owns shares of General Electric. The Motley Fool recommends Cisco Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.