(Amazon Echo DotYouTube/f0t0b0y)

We’re barely halfway through January of 2017, and it’s already looking like this is going to be the year of Amazon’s Alexa, the virtual assistant at the heart of the Amazon Echo.

In 2016, the Amazon Echo line of devices appeared to have a great sales year, with the cheap Echo Dot smart speaker finishing out the holiday shopping season as the best-selling item on all of Amazon.com. Forrester research estimates that 6 million Amazon Echo devices were sold by the end of 2016.

And at the Consumer Electronics Show in the first week of January, Amazon dominated the conversation. LG, GE, Ford, and lots more companies announced gadgets, home appliances, and even cars that can connect to Alexa. The market for the Echo is still small compared to smartphones, but it’s growing fast.

It’s all led to the conventional wisdom that Amazon is winning the race to rule the growing market for voice assistants and the apps that run on them, and, by extension, the still-very-young market for smart home gadgetry. And so far, Alexa has run this race largely unchallenged.

View photos

(LG announces its new Amazon Alexa-powered smart fridge at CES 2017David Becker/Getty Images)

Unchallenged until now, that is. With the Google Home device and its Google Assistant, the search giant is looking to eat Amazon’s lunch. Microsoft is positioning its Cortana personal assistant as the artificially intelligent way to get work done. Even Apple is said to be working on an Echo-esque device.

Here’s a look at how Amazon propelled itself into this leading position in the first place, where its biggest rivals still have room to overtake it, and why Apple needs to move in on this sooner rather than later.

Why Amazon leads

“[Amazon Echo] took us all a little by surprise,” says Gartner Research Director Werner Goertz.

A big part of Amazon’s early success with the Echo, launched in 2014, is due to the fact that the company didn’t oversell it. After years of iPhone users getting let down by Siri, the first truly mainstream voice agent, Amazon billed the Echo as a speaker that, by the way, has a few smart voice commands built in.

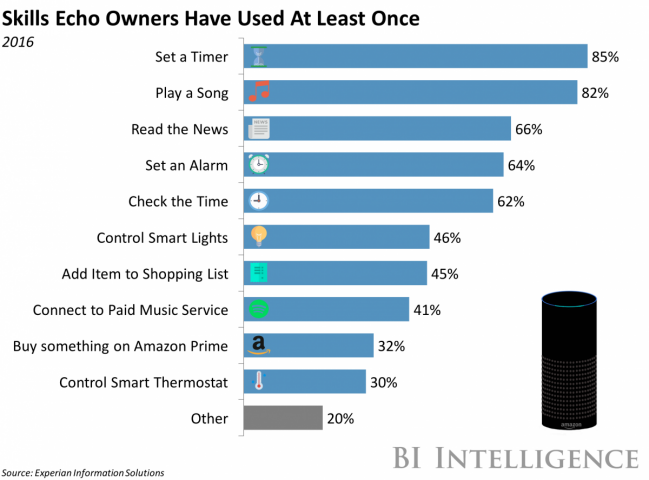

Then, just as people got accustomed to the idea of talking to Alexa, and positive word of mouth spread, Amazon added more capabilities. Alexa now boasts thousands of “skills” that allow it to connect with apps like Uber and Twitter, or Nest thermostats. Suddenly, Echo went from a novelty to a whole ecosystem unto itself.

Meanwhile, Echo plays right into Amazon’s core retail business by making it “frictionless” to buy things, Goertz says. Indeed, Goertz says that he hasn’t been to the grocery store in three months because he’s made all his food purchases on Amazon via shouts at Alexa.

View photos

(BI Intelligence)

The overall play for Amazon, says Forrester Principal Analyst Thomas Husson, is to continue to make Alexa more useful with more smart home integration and more media capabilities. Why? The more people use Alexa devices, the more likely they are to spend money on Amazon. And so, unlike many rivals, it can afford to take a loss on the gadgets.

“Amazon will increasingly subsidize Echo by bundling content (think music, video) with the device,” Husson says. “They can afford this since this is not core to their business model: the end-goal is to facilitate interactions.”

And not only does Echo encourage you to shop more, Husson notes, but it also feeds more data back into Amazon’s all-important recommendation machine, so the website and apps can, again, encourage you to buy more.

Where Google can compete with Alexa

Google has two key advantages over Amazon as it pushes its Google Assistant strategy.

First, “Google benefits from its huge search inventory, and has invested for longer in machine learning than its rivals,” notes Forrester’s Husson. The search giant is better than anyone else at, well, search. And it’s better at delivering answers to questions, which is basically the major thing a voice assistant needs to do.

Second, there are estimated to be over 1.5 billion Android users out there in the world, all of whom have phones that could theoretically get upgraded with Google Assistant (whether they will or not is a different story). Plus, Assistant is built into Google Allo, the company’s latest messaging app, and Google Pixel, the company’s flagship phone.

View photos

(Google HomeGoogle)

These are both things Amazon presently struggles with. In Business Insider’s own tests, Google Assistant outmaneuvers Alexa and the other voice assistants when it comes to performing everyday tasks. And while Amazon’s Alexa is only now starting to appear on phones and TVs, Google’s Android is everywhere.

Though it’s not entirely yet clear how the Google Home or the Assistant will play into Google’s advertising-driven model, it’s important that they keep with this market until it bears fruit. “For them, this is vital since this is simply about the future of search,” says Husson.

Where Microsoft can compete with Alexa

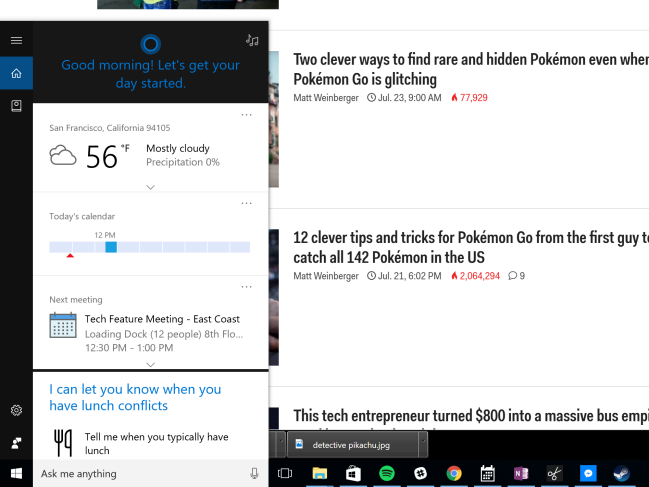

The strategy, Microsoft recently explained to Business Insider, is to make its Cortana virtual assistant the voice agent of choice for businesses and busy professionals.

Like Google, Microsoft has been investing heavily in artificial intelligence, and boasts some of the most advanced technologies for having human-like conversations with virtual agents like its own Cortana, which comes with every installation of Windows 10.

But Microsoft has a special ity all its own: It’s been the dominant player in business productivity software for the last several decades, with deep hooks into Microsoft Office, Microsoft Dynamics sales software, and soon, the LinkedIn professional social network.

View photos

(Microsoft Cortana in Windows 10Matt Weinberger/Business Insider)

And because of that dominance, it has relationships with companies like Nissan and Volkswagen, both of whom are embedding Microsoft technologies in their cars. Nissan is even going so far to embed Cortana in the dashboards of its next-gen cars. Microsoft sees Cortana as helping you be productive anywhere, even in the car where your hands aren’t free.

Microsoft has its own challenge, though. While Microsoft’s Cortana is starting to come to outside devices, including Nissan cars and a Harman Kardon-manufactured Echo-like speaker, it’s still primarily on Windows 10 devices. And as of September 2016, there are only 400 million of those, compared to the billion-plus of Apple iOS and Android.

Why Apple needs to get started now

“[Apple has] all the pieces of the puzzle: an installed base of more than one billion devices, Apple Music, Beats, Siri, et cetera,” says Forrester’s Husson. “They could very well combine these and deliver a more intuitive user interface.”

And yet, the clock is ticking for the most valuable company in the world, as the aggressive moves made by the other major players could squeeze Apple out before it even has a chance to get in the game.

“The room for Apple to enter the space gets smaller and smaller every day,” says Gartner’s Goertz.

Look at it this way: If you buy a new fridge that has Amazon Alexa built in, you’re probably not going to even look at competing virtual assistants until it’s time to replace it. Otherwise, you run the risk of your fridge not talking to your smart bulbs, or not talking to your home security system. Or at least, you’d have multiple voice assistants talking at you across your house, which could get annoying.

View photos

(Siri on the Apple TVApple)

In that situation, “Alexa has you locked in for the next several years,” Goertz says.

Meanwhile, the promise of Apple’s own HomeKit connected home solution is still “underdeveloped” and “not that cohesive,” Goertz says, encouraging customers and smart home vendors alike to look elsewhere. And while the company has pitched the Apple TV as the hub of the smart home, thanks to its Siri integration, it’s less convenient than the always-on Amazon Echo or Google Home experience.

Still, Husson is optimistic: “Apple is rarely a first entrant into a market, but they could well create a differentiated experience like they did for touchscreens,” he says.

NOW WATCH: We got our hands on the Home — Google’s answer to the Amazon Echo

More From Business Insider