The wrong kind of connected car, texting and driving

Often, especially outside the United States, mobile telecom operators trade at depressed earnings multiples. They do so even though the markets they act in are de facto oligopolies (due to spectrum licensing), and mobile operators tend to be cash cows. There are many possible reasons why this happens.

One of the reasons has to do with perceived large competition. This happens because mobile telephony has high fixed costs – to provide the infrastructure which enables the wide provisioning of the service. It then has low marginal costs, that is each additional subscriber doesn’t cost much to serve. As a result, every operator has an incentive to act very promotional to steal subscribers from the others.

Additionally, mobile telephony is seen as very capital intensive. This is so because providing the infrastructure is very expensive. On top of it, mobile operators need to buy spectrum licenses to serve each market. The capital intensiveness, though, is somewhat cyclical. It happens when the network is first built, and at large technological jumps, like 3G, 4G or in the future, 5G.

A final reason, which is very intuitive, is that everybody already seems to have a mobile phone/smartphone. This speaks of stagnation. Take the United States. Back in 2015 there already were 118 mobile subscriptions per 100 people. Of course, stagnation/no growth is the sworn enemy of higher earnings multiples. It is in what regards this growth reason that there are some good news.

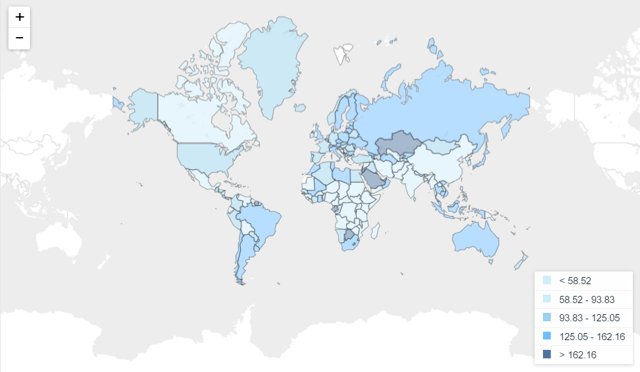

First, there’s the fact that in many countries the penetration rate (mobile subscriptions / 100 pop) is handily surpassing 100. As we saw, it was at 118 already in the United States. It’s even higher elsewhere, as we can see from the map below:

Source: The World Bank; Mobile cellular subscriptions (per 100 people)

There are a few obvious reasons for this:

- Having a work phone and a personal phone.

- Or having other connected devices, like tablets and laptops.

- Or having an affair.

In some places, like China, double SIM phones have become very popular. With these the same smartphone can have two different numbers/subscriptions.

This phenomenon permits the penetration rates to go well over 100, as we saw. It thus enables mobile operators to provide subscriptions well in excess of population. It puts the limit of how much they can grow, the TAM of the market if you will, farther away.

There’s yet another example that’s set to widen the market further. Generally speaking, that would be the IoT (Internet of Things). As each “thing” (device) requires a web connection, so too it will require a mobile subscription (unless it can get its connection from a local network, say through WiFi). This might yet make mobile operators the best bet on IoT. After all they’re already cheap and profitable and stand to directly make even more money from it.

A special case of “things”, in this regard, would be cars. Connected cars. Cars which connect to the internet for the most various things, from getting OTA (over the air) updates, to transmitting car data home and providing remote diagnostics, etc. Tesla (NASDAQ:TSLA) is particularly well-known for this, though General Motors (NYSE:GM) has had OnStar since 1996 and now has more than 1 million subscriptions to it.

Each of those connected cars will have a mobile subscription – and someone (a mobile telco) will be charging for it. For instance, OnStar was handled by Verizon (NYSE:VZ) until 2013, and then the contract was switched to AT&T (NYSE:T).

As with people, it’s likely that over time cars having mobile connections will evolve to “infect” nearly the entire fleet. This is pretty relevant, because there are quite a few cars out there. For instance, as of 2014 there were 797 cars per 1,000 people in the US. What this means is that cars alone have the potential to increase the number of mobile subscribers by around two-thirds over time.

Of course, a mobile subscription for a car is going to be much cheaper than the same for a mobile phone. This is so because of the use it’s given and the fact that those subscriptions will likely be negotiated on wholesale terms by auto makers. Still, since the marginal cost of adding subscribers to a mobile network is very low, much of the increased revenues from this trend will translate into profits.

Moreover, these will be data revenues. Data is another favorable development for telcos. This is so because data eats up spectrum capacity much faster than voice. Typical codified voice will eat 8-67Kb/second. Quality music is more like 10x the upper bound. Video (720p, H.264) would be around 40x the upper bound. LTE data rates are up to 1400x higher than the upper bound for voice (though they’re used in bursts and the capacity is shared by many subscribers).

Data eating more spectrum and spectrum being limited (and licensed) can have a large impact on mobile telecom operators. The incentive to compete because of a low marginal cost happens because there’s free capacity to be filled up (marginal cost is low as long as you don’t have to expand capacity). If capacity, here defined as spectrum use, can be filled faster, then the incentive to compete is diminished. Thus, data filling up available spectrum bandwidth faster than voice translates into a less-competitive environment over time, in what is otherwise already an oligopoly.

Conclusion

The Internet of Things will favor mobile telcos. Within the Internet of Things, cars are the most obvious thing that’s getting connected already.

There are a lot of cars. In places, nearly as many as people. So cars getting connected will provide a further expansion opportunity for mobile telecoms, which could otherwise be seen as irreparably stagnated.

Finally, car connections will be data connections. Increased data usage also favors mobile telecoms as it enables to fill up available spectrum faster, leading to lower competitive pressures.

Disclosure: I am/we are short TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.