This story was delivered to BI Intelligence IoT Briefing subscribers. To learn more and subscribe, please click here.

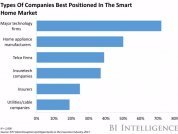

Over the past year, the world’s largest tech companies’ smart home ecosystems have taken shape, and the market strategies for the three largest of these companies is now clear.

However, as Reuters notes, this will set the companies on a collision course with each other as the smart home matures and becomes a more mainstream consumer service.

- Apple’s HomeKit is centered on sales of the iPhone, the remote of the HomeKit ecosystem. While the entire ecosystem is built around Apple products, with the Apple TV or iPad serving as the hub for the HomeKit ecosystem, the iPhone is the only prerequisite for a user to set up an Apple Home ecosystem. Users can still operate the ecosystem without an Apple TV or iPad, albeit only from inside the home rather than remotely. This helps the company because each iPhone user with iOS 10 has the ability to set up HomeKit devices and use Apple products to adopt the smart home.

- The Google Home is centered on targeting users with ads. The company is one of the largest in the world to rely on ads as its primary stream of revenue, announcing a whopping $79.4 billion from its AdSense division on its earnings call last week, the overwhelming majority of the Alphabet parent’s total revenue. While Alphabet bought the device makers Nest and Dropcam in recent years, it doesn’t have the built-in user base that Apple has with iPhone. It may boast a technological advantage in the Google Assistant, however, over Alexa and Siri at this point, as Sundar Pichai argued on the company’s earnings call.

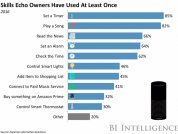

- Amazon’s Echo products are designed to be an access point to the Prime network. As BI Intelligence has previously identified, the online retailer’s monetization strategy doesn’t focus on the hardware of the Echo devices, but rather on connecting users directly to the Prime network without having to go through an iPhone or Google search engine to do so. This creates a recurring revenue stream for the online retailer. As Alexa’s reach continues to expand, it will become an even larger monetization asset for Amazon by allowing more points of entry into the Prime network.

But Apple may fall behind Google and Amazon due to its heavy reliance on iPhone sales to monetize the smart home. As previously noted, Apple is only one of the three companies listed above to rely on hardware to drive revenue in the smart home space. Amazon and Google will continue to be able to monetize the smart home even if the sales of their hardware decline, which is especially relevant given the recent trend of iPhone sales stagnation. But with a new tenth-anniversary iPhone on the horizon this year, the company might be able to overcome this at least temporarily. Further, despite that the company might not be able to get more people to buy iPhones and set up HomeKit, it still has a massive iPhone user base that works to its advantage.

The U.S. smart home market has yet to truly take off. At its current state, we believe the smart home market is stuck in the ‘chasm’ of the technology adoption curve, in which it is struggling to surpass the early-adopter phase and move to the mass-market phase of adoption.

There are many barriers preventing mass-market smart home adoption: high device prices, limited consumer demand and long device replacement cycles. However, the largest barrier is the technological fragmentation of the smart home ecosystem, in which consumers need multiple networking devices, apps and more to build and run their smart home.

John Greenough, senior research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on the U.S. smart home market that analyzes current consumer demand for the smart home and barriers to widespread adoption. It also analyzes and determines areas of growth and ways to overcome barriers.

Here are some key takeaways from the report:

- Smart home devices are becoming more prevalent throughout the US. We define a smart home device as any stand-alone object found in the home that is connected to the internet, can be either monitored or controlled from a remote location, and has a noncomputing primary function. Multiple smart home devices within a single home form the basis of a smart home ecosystem.

- Currently, the US smart home market as a whole is in the “chasm” of the tech adoption curve. The chasm is the crucial stage between the early-adopter phase and the mass-market phase, in which manufacturers need to prove a need for their devices.

- High prices, coupled with limited consumer demand and long device replacement cycles, are three of the four top barriers preventing the smart home market from moving from the early-adopter stage to the mass-market stage. For example, mass-market consumers will likely wait until their device is broken to replace it. Then they will compare a nonconnected and connected product to see if the benefits make up for the price differential.

- The largest barrier is technological fragmentation within the connected home ecosystem. Currently, there are many networks, standards, and devices being used to connect the smart home, creating interoperability problems and making it confusing for the consumer to set up and control multiple devices. Until interoperability is solved, consumers will have difficulty choosing smart home devices and systems.

- “Closed ecosystems” are the short-term solution to technological fragmentation. Closed ecosystems are composed of devices that are compatible with each other and which can be controlled through a single point.

In full, the report:

- Analyzes the demand of US consumers, based off of survey results

- Forecasts out smart home device growth until 2020

- Determines the current leaders in the market

- Explains how the connected home ecosystem works

- Examines how Apple and Google will play a major role in the development of the smart home

- Some of the companies mentioned in this report include Apple, Google, Nest, August, ADT, Comcast, AT&T, Time Warner Cable, Lowe’s, and Honeywell.

To get your copy of this invaluable guide, choose one of these options:

- Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

- Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the smart home market.

Learn more:

- What is the Internet of Things? Definition, Industries and Companies

- IoT Ecosystem – Forecasts and Business Opportunities

- IoT Market Size, Share & Growth Forecasts

- IoT Trends, Growth & Predictions

- IoT Devices, Applications & Examples

- Top IoT Companies to Watch & Invest In

- IoT Wearable Devices & Technology

- How IoT Will Affect Security

- IoT Reports