Investment Thesis

Global Leader in Internet of Things Space

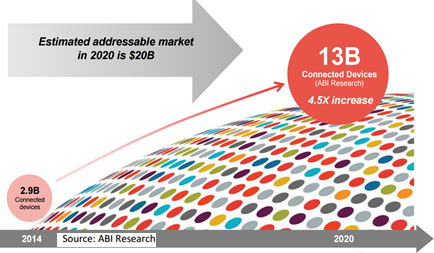

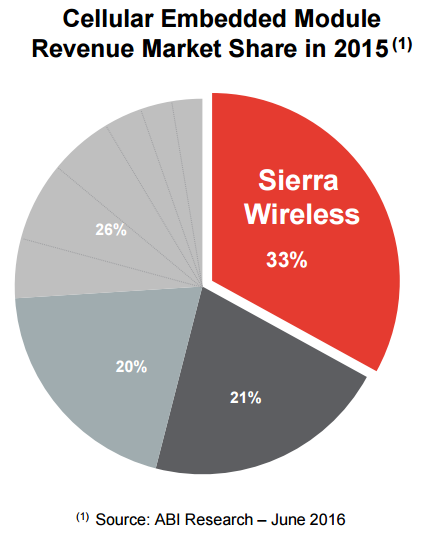

Sierra Wireless (NASDAQ: SWIR) is the global leader in embedded cellular modules for the Internet of Things. The Internet of Things is still in its infancy with 2.9 billion connected devices in 2014 and a wide array of estimates ranging from 13 billion to 50 billion connected devices by 2020. Some investors have raised concerns that much larger companies such as Cisco (NASDAQ: CSCO), Huawei or Ericsson (NASDAQ: ERIC) will take market share from Sierra Wireless. However Sierra Wireless has repeatedly shown it can fend off competition and maintain its substantial 33% market share. As Netflix (NASDAQ: NFLX) and Facebook (NASDAQ: FB) have demonstrated, being first in a huge growth market and the expertise that comes with being first provides a competitive advantage that Sierra Wireless continues to capitalize on. I postulate that there is upside for investors in the IoT space who could also get exposure by investing in Cisco or other publicly traded companies. However, Sierra Wireless is a pure play on the IoT and with a market cap of $450 million there is a lot of room for growth.

Strong Growth and Cash Position with No Debt

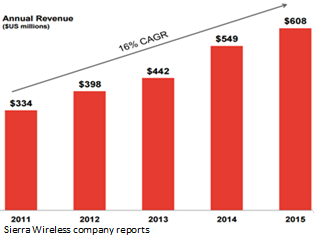

Sierra Wireless has more than $80 million in cash and no debt leaving them in a strong position for further acquisitions and ample operating liquidity for the next few years. Sierra Wireless’ strong cash position allowed for several acquisitions in 2015 such as Wireless Maingate AB, Accel Networks and MobiquiThings SAS, providing further growth, consolidation in the IoT space and affording SWIR with the ability to provide end to end, cloud to device service. Growth via acquisition coupled with strong organic growth resulted in a five-year CAGR of 16% and I project forward five-year CAGR of 6%. With a price to sales ratio of 0.8x, investors are not pricing in any growth for SWIR.

Blockchain Technology Not Priced In

Blockchain technology is being touted as the most significant technological innovation since the Internet, with some experts suggesting its impact could be as big as the Internet itself. For the first time the Internet, using distributed immutable ledgers, can allow for the exchange of value without the need for an intermediary validating parties to a transaction. Well that’s great, but how will the IoT and Sierra Wireless benefit from blockchain technology? There are a vast number of IoT applications that have already been identified, however some aspects of IoT have been held back due to security concerns. Using cryptography and blockchain technology, security issues will be mitigated, while the benefits will multiply as the data that is generated can be harnessed by IoT and technology companies when addressing consumer’s needs. Imagine a vending machine that can not only monitor and report on its own inventory but can also solicit bids from producers and automatically pay distributors using data it has obtained from sales to customers. Using blockchain technology, individuals and corporations could be incentivized to own and distribute IoT devices due to the inherent reward mechanism while acting as nodes in the blockchain. For example, users scattered throughout the world could have IoT devices on their property (or on their body/clothing) that are tasked with gathering data from the environment and reporting it on the blockchain which would ultimately be used to predict weather patterns. For supplying the computing power and participating in the blockchain, users would be rewarded with micropayments, which could help the IoT proliferate. Very few people are yet to discover the potential of the intersection of IoT and blockchain technology and for this reason SWIR is positioned for success.

Competitive Landscape

There are scores of companies operating within the IoT space ranging from mega cap to micro ap as well as publicly and privately listed. The largest operators in the space are Google (NASDAQ: GOOG) (NASDAQ:GOOGL), Cisco, Intel (NASDAQ: INTC), IBM (NASDAQ: IBM), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN) and many others. Google took a massive leap into the connected home space with its $3.2 billion acquisition in February 2014 of Nest Labs, a smart home thermostat and smart home fire and carbon monoxide detector company. And you can bet that is only the beginning of Google’s foray into the smart home market. Cisco is one of Sierra Wireless’ more direct competitors as a producer of connected routers. Additionally, Cisco also produces switches and application centric networking software and security. Intel also focuses on hardware, although not competing directly, by building semiconductors and chips. IBM operates in the software space by providing enterprise application infrastructure and databases for connected devices as well as IBM’s Watson IoT platform and a recently announced collaboration with AT&T. Amazon, with its Amazon Web Services business being the largest infrastructure cloud player, has platforms to build IoT applications and Microsoft has made a push into IoT with the Microsoft Azure Stream Analytics platform for connected devices. IBM, Amazon and Microsoft could provide significant headwinds in Sierra Wireless’ nascent goal of increased profits and fatter margins in the cloud space. Sierra Wireless had $21MM in revenues in 2015 for its Cloud and Connectivity Services division after moving into the space with recent acquisitions.

Two smaller firms that are competing more directly with Sierra Wireless with embedded cellular modules are Gemalto NV (OTC: OTCPK:GTOMY) and Telit Communications PLC (OTC: OTCPK:TTCNF). Gemalto began as a digital security company providing software applications and secure personal devices and with a great reputation for security they could be a trusted partner for OEM customers and others that are looking for secure connections between machines and cloud applications. However, Sierra Wireless with 100% of their efforts on the Internet of Things may have a competitive advantage over Gemalto, which only garners roughly 10% of total revenue from their machine to machine (M2M) business. Telit competes directly with Sierra Wireless in the connectivity M2M space, although with only $333 million in revenues for 2015 does nearly half the business Sierra Wireless does and with only $29 million in cash has less flexibility to acquire more IoT assets.

Sierra Wireless is the clear leader in the Internet of Things space and according to ABI Research SWIR had 33% market share in 2015, while its closest competitors have 21% and 20% and many others lagging far behind. ABI Research estimates that the market for cellular embedded modules will be worth $4.9 billion by 2020. If Sierra Wireless can maintain its 33% market share that would equate to revenues of $1.6 billion and does not account for revenues from their Enterprise Solutions or Cloud and Connectivity Services businesses (my DCF is conservative with SWIR revenues at $840 million in 2020).

EV/EBITDA Sensitivity Analysis

My target price is predicated on an EV/2020 EBITDA multiple of 14x (50% weighting) and a DCF analysis (50% weighting), resulting in a target price of $17.50.

EV/EBITDA multiple: An EV/EBITDA multiple for 2020 of 14x and a 7.5% WACC results in a $17.00 target price.

DCF Analysis: Assuming revenue CAGR of 6.3% through to 2020, a WACC of 7.6% and terminal growth rate of 2%, I arrive at a price of $17.85 using a discounted cash flow analysis.

Key Risks to Target Price

Investing in Sierra Wireless is not without its risks. Deterioration in the general health of the global economy could cause Sierra Wireless’ customers to cut capital expenditures, which we have already seen in the past two quarters as key automotive OEM customers have reduced spending due to softer expected sales. Secondly, as the IoT is potentially a large growth opportunity, competition from new (e.g. Google) or established IoT providers such as Huawei, Ericcson or Cisco, which have significantly greater resources, could eventually eat away at Sierra Wireless’ large market share. Thirdly, we have also seen in recent years concerns regarding privacy from individuals and governments which could provide the impetus toward more regulation as some people may be disconcerted with the amount of data that can be collected from physical assets, especially given there is so little clarity around what data is actually being collected and how that data is being used. Furthermore, technological constraints may pose challenges preventing the broad adoption of IoT. Odds are if you work for a large corporation you are using multiple technology applications and programs that are more than 20-years-old and the only reason they have not been updated is due to the substantial cost and the amount of effort to move the organization onto updated technology while ensuring business continuity. Finally, it is possible that blockchain technology does not live up to the hype and provide all the solutions it is hypothesized to do.

In closing, investors may require patience as Sierra Wireless overcomes some slowness in OEM sales and begins to grow out their Enterprise Solutions and Cloud and Connectivity Services businesses. However, investors with a long-term investment horizon will be rewarded with Sierra Wireless’ industry leading expertise and their strong cash position and no outstanding debt allowing them to weather a slowdown before the IoT is catapulted further by the inclusion of blockchain technology and mainstream adoption of IoT devices.

Disclosure: I am/we are long SWIR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.