With almost all leading telecommunications companies in the United States now offering unlimited data plans, home network manufacturers such as Netgear (NASDAQ:NTGR) have been tipped to feel the pinch as consumers ditch Wi-Fi at home in favor of using their smart devices for all their internet usage. But we think one thing some market commentators are forgetting is the meteoric rise of the Internet of Things, also known as IoT. As more and more devices become connected, we expect companies like Netgear to see a resurgence in demand for routers that can efficiently handle the high number of devices connecting to the internet around homes. Because of this we think Netgear is in a solid position to profit, making it a great long-term investment option.

Connectivity is rapidly shoe-horning its way into every object which Silicon Valley start-ups can get their paws on. First conceived in the late 90’s due to a stock supply shortage of lipstick, the internet of things initially consisted of sensors relaying data to computers. Now, the things have computers installed in them, the same product – only smarter. Wrist watches which can relay heart rates and average jogging speeds, mattresses which tell us about our sleeping patterns, and the list goes on. Many devices nowadays require a constant high-speed data connection in order to fulfil their status as a smart device. According to Bloomberg, Swedish network equipment maker Ericsson has forecast there to be 29 billion connected devices worldwide by 2022, up from 16 billion last year. Interestingly nearly all of this growth is expected to come from devices that aren’t phones or computers.

But with so many devices connecting around the home, consumers with older routers are experiencing the degradation of signals, a lack of full coverage around the home, and poorer quality internet. As Bloomberg explains: “Routers compete for airwaves with cordless phones, baby monitors and nearby Wi-Fi signals. When a neighbor moves in, changes a setting or downloads a movie, it can interfere. A network can also get overwhelmed by the addition of new devices and create the equivalent of rush hour on a Los Angeles freeway.” It then explains that: “This is because older devices connecting to a traditional router look for a reasonably uncongested lane of wireless spectrum, then stay in that lane regardless of how backed up it gets.”

While using your cell’s unlimited data plan at home might seem like a quick fix, it’s not really the answer for a home with multiple devices connected to the internet at the same time. When that cell leaves with its owner for work, does the home then go without internet? We think not. We think the real answer is a router refresh and Netgear’s Orbi could be in pole position.

As well as being able to efficiently handle high numbers of connected devices, the Orbi router comes with extenders for around the home or office which can boost a Wi-Fi signal to fill in those black-spots. With several units which chatter to one another on a third frequency band, there is no impact on your 2.4GHz or 5GHz Wi-Fi connection. Another key selling point in our opinion is that although it has been designed to handle complex tasks, the Orbi unit is extremely easy to set up.

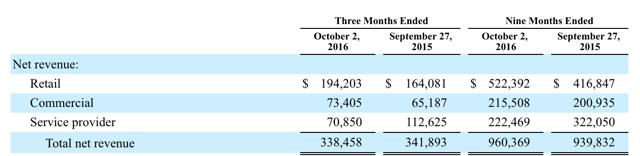

With Netgear focusing its attention on providing solutions for the smart home, we expect to see its retail segment continue to perform strongly for the next decade. Pleasingly year-to-date sales are up 25% in the segment. But even more pleasing is the fact that segment margins have improved from 12.9% to 14%. This increased profitability was the result of the company’s strategy of pursuing higher average selling prices, something we expect will result in further margin improvement over the next few years. This is because in our opinion consumers are now aware that cheap routers are cheap for a reason. If they want a smart home to operate efficiently, they need to pay a little more for the privilege. Thankfully with consumer confidence climbing higher, we feel consumers will be okay with this.

Not that we expect fireworks in the fourth quarter. Traditionally the fourth quarter is a slower quarter for its retail unit. Furthermore, the company expects a smaller contribution from its Service Provider segment. Hence why management expects net revenue in the range of$340 million to $355 million during the quarter. This will bring full-year revenue to between $1.300 billion and $1.315 billion, compared to $1.33 billion in FY 2016. Instead we feel that next year is where we will see Netgear start to benefit. Our forecast is for top line growth of 15% to approximately $1.5 billion, thanks largely to its retail segment continuing its strong performance. And with margins continuing to expand, we have forecast earnings per share of $3.72. This is an increase of 18% on the analyst consensus for the current year.

Which based on a conservative PE ratio of 16, gives us a 12-month price target of $59.52, approximately 15.7% higher than the last close price. This return, along with its bright long-term growth prospects, hefty cash balance, and next to no debt, makes Netgear an ideal addition to most portfolios in our opinion. For this reason we have recently opened a long position with the networking solutions provider.

Disclosure: I am/we are long NTGR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.