Brett King believes he knows precisely where the financial services industry is headed in the future, and he has already built a platform designed to get the rest of us to that future as quickly and seamlessly as possible.

That platform is called Moven. As a financial service provider, Moven and its partner, FDIC-insured CBW bank, provide users with real-time insights to empower them to make informed decisions as they bank.

Benzinga spoke with King about Moven and about the future of banking.

Benzinga: What are some of the features that make Moven unique?

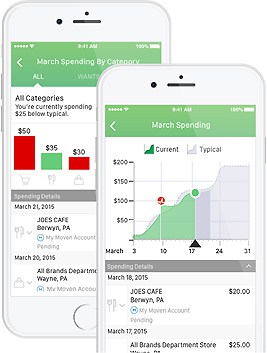

Brett King: The primary thing that makes Moven unique is its ability to actually generate behavioral changes around spending. We have statistical evidence now to suggest somewhere between 30% and 50% of the user base is regularly saving more money than their contemporaries who don’t use Moven as an app.

Another important aspect is the fact we were the first app in the world to allow you to sign up for a bank account in a mobile app. It’s a simple two-minute signup procedure.

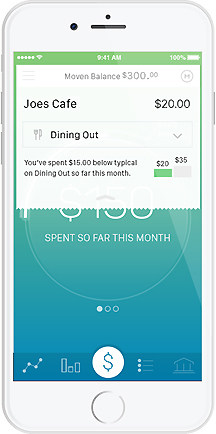

As a banking app Moven is quite different. It allows normal banking money movement – transferring funds, paying bills and so forth – but is unique in the sense that it provides ongoing real time advice to help you understand and manage your spending.

Explain Moven’s relationship with Amazon (AMZN) Web Services

Brett King

Brett KingIn 2016 Amazon Web Services accounted for 31% of the cloud market. We are currently the top neobank on AWS. We have the largest footprint of any cloud-based neobank. We think this is significant because it allows us to offer a much more scalable solution as a service provider. We can pretty much deploy Moven within days anywhere AWS is accessible in the world.

From a security perspective, when we did comparative tests, we found that in five out of the six tests, AWS outperformed our bank partners on a security basis. That’s primarily because AWS is constantly being tested and hacked. It’s like an immune system. The more you have to defend yourself, the stronger you become.

Where and how did the idea for Moven originate?

The story starts with my first book launch. I had written Bank 2.0, which is about how customer behavior and tech will change the future of financial services. I was on a global tour, had been to Singapore, London, New York and eventually Los Angeles.

When I arrived in New York I met with guys at Simple, who were thinking of starting their own bank. I’d been thinking about the potential for this as well. Just hearing Simple’s plan got me thinking of the possibilities.

When I got to Los Angeles I met with a bunch of interesting venture capitalists and movie producers – all players from the LA scene. They had some really interesting questions to ask me and as I began to describe the bank account of the future I suddenly realized I was describing the bank I’d like to build.

Near the end of that conversation, William Quigley [general partner at Clearstone Venture Partners] said, “Banks are not going to want to do this.” That was the moment when the penny dropped. I realized this idea would be counterintuitive for banks. That’s when I realized this was a real window of opportunity.

What did you do next?

I went back to my friend’s apartment in Malibu where I was staying and within an hour had registered the name Moven Bank, which is a contraction of Move and Bank.

This was in August 2010. By November 2010 I had started to put together a bit of a team. We hired our first developer in 2011. Not long after that we formally founded the company and in 2012 did our first round of seed funding.

This was the birth of Moven, a mobile bank account designed for millennial users and mobile users alike.

These things never go without struggles. How did you overcome them?

You have to be absolutely consistent to make these things work. At some point, something will happen that will threaten to undermine the entire opportunity. Most entrepreneurs will tell you that unless you have this very clear vision and unyielding focus, at some point in time you will give in.

There have been a number of times the business could have failed. Weeks before our launch our primary partner for payment processing was acquired and no longer available to us. Then we lost our bank partner because we didn’t have a payment processor. Basically, six weeks out from launch, the entire backend support infrastructure was gone. Fixing that was a major struggle.

In addition, there were times we ran out of money and were still in negotiations for our next funding round. All told there were multiple occasions when, if we didn’t have that unyielding focus, the business would have gone under.

What have you learned in creating and launching Moven?

We are learning how to manage our relationship with our customers almost entirely digitally. This involves being able to design a system that requires minimal face-to-face interaction or none at all.

Ultimately, I think what that is going to do is put pressure on traditional banks that continue to force people into the branch. I think we are starting to show that doing this is a very expensive and unnecessary way to do business.

Getting down to the nitty gritty, how will banking change in the future?

We are seeing a move away from thinking about banking as products to banking as an actual embedded utility in our lives through technology.

For example, in the old days, if you wanted to get the balance in your account you would check your passbook. After passbooks you had to go to an ATM or a branch. Then internet banking came along allowing you to check online. If you have Amazon’s Alexa, you can just ask Alexa, “What’s my account balance?” So that simple process is now much more seamless.

With credit, the shift from product to embedded experience will represent a dramatic shift. For example, today if you walk into a grocery store and don’t have enough money for what you want to buy, you won’t find that out until you go to the checkout.

In the future, when you walk into the store your smartphone will say, “We know you normally spend about $600 here but your account only has $250 in it today. Would you like the extra $350 so you can complete your shopping today? The fee will be $21.”

Any other examples?

Sure. Say you walk into an Apple store looking for a new iPhone. When you arrive you might get an automatic offer for financing for 12 months’ interest free. This is contextual, as opposed to applying for a credit card in case you might need it.

Buying a house will change. Now when you want to buy a house you have to apply for a mortgage, fill out a lot of paperwork and wait for approval. In the not too distant future when you walk in a home your smartphone will tell you whether you can afford the house and at what price. It will also tell you what banks will give you the best interest rate. If you agree, the contracts will be done between the bank, the Realtor and you in real time.

Suppose you are shopping for an autonomous car in the future and discover it costs more than you can afford. Your smartphone might deliver an offer from Uber to help finance the car in return for which you let Uber borrow the car for a few hours each week as an autonomous taxi. All of these examples are about lowering the friction of financial transactions to the minimal amount.

This is all very exciting. Where does Moven fit in to the future of banking?

Moven is attempting to build toward that future I just talked about. This is an overarching trend that started with the emergence of the internet and has accelerated with technology like the smartphone. We have to redesign the world around us based on different types of interactions.

Moven is designed to sit on top of this new financial reality. It’s a vision of how a bank account of the future will work. It gives you everything you need with a bank account but also gives you advice on how to use and manage your money as you are spending it. We think of it as a smart bank account.

This article is exclusive to Nasdaq.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.