Intel (NASDAQ:INTC) had its analyst day last week, and several worries surfaced as a result. None of these are new, but they are manifest enough to have knocked a few shades of Intel’s share price in the aftermath, although it has recovered a little in the latest stock market rally.

Intel is of course hobbled by the secular decline in the PC market as their Client Computer Group (“CCG”) is still good for 55% of revenues and it enjoys high margins.

Despite the fact that Intel was able to increase the CCG revenue in the face of a declining market, worries are accentuated by the slowdown of Intel’s tick-tock strategy of introducing new processors (that’s now a ‘tick-tick-tock’ strategy, slowing down the pace of introduction of new process technology).

So the move towards 10nm production has been postponed a few times and the first chips from the new process might now arrive towards the end of the year. But it’s hardly reassuring that 14nm products are extending their lifespan into another ‘tock’ reiteration (after Kaby Lake comes Coffee Lake).

This seems to extend the model from ‘tick-tock’ to ‘tick-tock-tock-tock-tock,’ as Coffee Lake is the fourth generation 14nm product. And all this just at a time of a resurgence of competitor AMD.

Then there are worries about the shrinking corporate datacenter market, and the lower margins that new growth opportunities entail.

There are a number of growth markets where Intel is reasonably placed to get a slice of the pie. Difficult to argue that the Internet of Things (“IoT”) offers by far the largest market opportunity, so we will look how Intel’s can benefit from the expected growth here.

As Intel moves its cash from cash cow segments where it has a dominant position like client computing and data center computing, it’s pouring in cash into sectors that have better growth prospects.

One segment that is supposed to be a growth center for Intel is the Internet of Things Group. It is certainly growing, but at present, it provides still under 5% of revenues so it will take a good while before this start to materially impact financials.

It achieved record revenue of $726M, a growth of 16% year over year. Operating profit for the business was $182M, up 37% year over year.

We’re at the very first inning of sensors and devices getting connected to the internet and accumulating data which will be digested into information (and increase the demand for servers and storage in the process), much of it enabled by AI.

According to McKinsey, the potential impact of IoT can be an aggregated $11 trillion business opportunity, equivalent to 11%(!) of the world economy over the next ten years. The biggest opportunities in IoT are probably in sectors like healthcare and manufacturing.

In healthcare, one can think of things like portable health monitoring, electronic record keeping and pharmaceutical safeguards. In industry, IoT solutions enable stuff like real-time analytics of supply chains, equipment and robotic machinery.

But IoT solutions also enable things like smart homes and smart buildings, which allow owners and occupants to monitor, manage, and maintain all aspects of the building that impact operations, energy, and comfort.

IoT also powers smart cities, enabling the monitoring and controlling of city assets and aspects of the environment, like traffic flows, pollution, public transport, hospitals, power plants, law enforcement, etc.

The whole thing will receive a big boost with the upcoming 5G network, but that’s a couple of years away, at best (even if Intel itself already has built a 5G modem). How is Intel positioned? Here is IoT Analytics:

Intel is at the forefront of developing new generation low-power chips for connected IoT devices. Intel R&D centers (so called Intel Open Labs) and a number of industry co-operations (e.g., Intel and Kuka’s PC-based robot-controllers) lay the foundation of Intel’s IoT push. Moreover Intel is targeting startups and developers. The Intel Galileo developer kit for anyone who wants to create their own thing is being marketed heavily throughout the world. The latest addition to Intel IoT portfolio is a platform for connecting the data from your things to the cloud.

If low-powered processors is the main competitive edge, then here too ARM is an increasing threat. Intel has its Atom processors, but the much tinier and frugal Quark SoCs and Curie modules. But it’s not just processing power, Intel is also providing whole solutions, for instance for retail and for autonomous driving (Intel GO).

The very large automotive market offers a good opportunity for Intel. Late last year, Intel vowed to spend $250M in two years towards the development of autonomous vehicles.

Intel already has cemented important partnerships. For instance, last month, Intel announced a partnership with BMW (OTCPK:BMWYY) and Mobileye (NYSE:MBLY) in order to deploy 40 autonomous vehicles on the road in the second part of this year. Their ambitions are substantial:

But BMW and its partners aren’t looking to just build self-driving 7 series sedans. The companies say they want to develop “scalable architecture” that can be adopted by other automakers and designers to plug into vehicles of different brands.

And last month, Intel made a strategic investment in HERE, a digital map provider:

Intel is acquiring a 15 percent ownership stake in HERE, a global provider of digital maps and location-based services for automotive and the Internet of Things (IoT). Companies plan to jointly develop a highly scalable proof-of-concept architecture that supports real-time updates of high-definition (HD) maps for highly and fully automated driving as well as explore opportunities in IoT and machine learning.

And again, solutions are likely to aim for a broad market, considering:

HERE is a private company, which is indirectly wholly owned by AUDI AG, BMW AG and Daimler AG. HERE is a global provider of embedded navigation solutions. By working with Intel, HERE aims to offer automakers a universal solution that reduces both complexity and long-term development costs.

If you think Intel is just a chip manufacturer, think again. They are targeting a wide variety of integrated IoT solutions, take precision medicine, for instance.

Ideally, gene sequencing should be ready for analysis and identification of targeted drugs. However, the data streams involved are simply too big and they obviously need to be secured. Intel has built solutions like:

- Cromwell, an open standards-based workflow integration engine that simplifies complex computational workflows and can launch genomic pipelines on private or public clouds in a portable and reproducible manner.

- GenomicsDB, a database built for genomic data that can store vast amounts of patient variant data and perform fast processing at unprecedented scale.

- The Genome Analysis Toolkit, the industry standard software package for high-throughput sequencing data. It is optimized for working with both Cromwell and GenomicsDB, with a primary focus on variant discovery and genotyping.

Not stuff one normally associates with Intel. And if you think this is the only integrated IoT solution, think again, or better, browse around the relevant part of the Intel website. There are multiple integrated projects in each segment like healthcare, automotive, energy, manufacturing, retail, smart buildings, smart homes, and smart transportation.

They will have to prove themselves in these complex projects, as this is not within the realm of their core competencies, at least not yet. There are other companies better placed here, the likes of Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM) and Google (NASDAQ:GOOG) (NASDAQ:GOOG) come to mind. They do have a partnership with Google for IoT cloud computing.

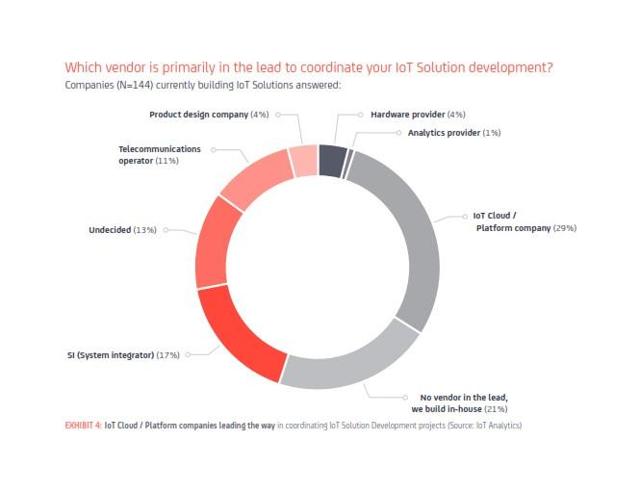

Take a look at the following figure (from a white paper guide to IoT Solutions from IoT Analytics):

Most often, IoT solutions are orchestrated by IoT Cloud/Platform companies. Nevertheless, IoT Analytics regards Intel as the top IoT company, but this is based on stuff like Google searches, Tweets, newspaper mentioning and employees on LinkedIn tagged with IoT. What is somewhat reassuring is that they’re way ahead of Qualcomm (NASDAQ:QCOM) in this space. GE (NYSE:GE) is actually the company with the highest IoT revenues ($5B).

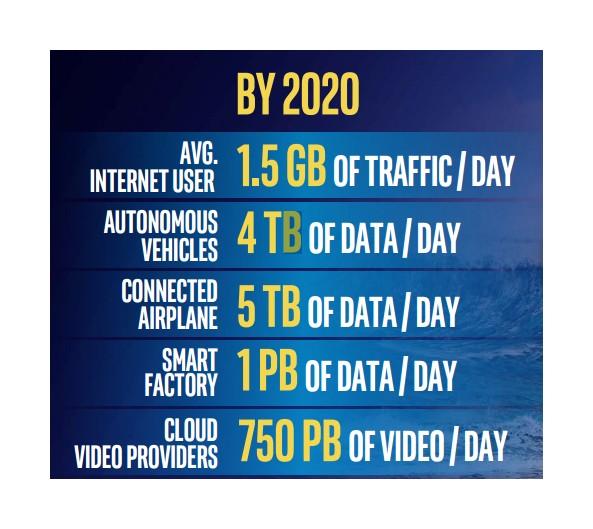

And there is another way to look at the IoT sector and what it can do for Intel. The enormous growth in data provides opportunities every step of the way. The following graph, from Intel’s analyst day last week, illustrates this:

All this data is not only collected by increasingly smart devices, it’s also sent, stored and analyzed, and in each step, Intel is positioned to take a part of the cut. Whether with the small energy-efficient chips that power the smart devices, the upcoming 5G modems where Intel is one of the first to offer a solution, the chips that run the data centers or the IoT platforms where Intel is also an increasing player.

This is why the IoT sector will experience by far the fastest increase in capital spending, again according to the presentation at Intel’s analyst day:

AI

It should also be noticed that some of these efforts benefit, or are complemented by Intel’s artificial intelligence (“AI”) efforts. After all, AI is mostly gathering vast amounts of data, often from the same devices that play a role in IoT solutions, and extract meaningful patterns from these data.

This is not where it stops, of course, as AI systems learn, that is, they become better at this over time. Intel is active in the AI field through stuff like:

- Offering server processors with deep learning capabilities like the Intel Xeon processor E5 family and the recently launched Intel Xeon Phi processor.

- The acquisition of Nervana Systems, a provider of deep learning platforms and capabilities. Nervana’s technologies are already included in Intel’s roadmap of product introductions.

- The Saffron technology platform (acquired in 2015).

- A strategic alliance with Google.

From the above-linked article about the Saffron acquisition, here is the rationale:

So how does a cloud-based software product that teaches computers to “think” relate to Intel, a chip company? The future of computing is pretty clear to those who know where to look. With everything from our homes to our factories connected and generating more information than can be stored in a single data center, let alone be processed by a human being, the race is on to build computers that can help people make sense of the digital information that threatens to overwhelm them.

One of the aims of the strategic alliance with Google is to address that data overload problem by enlisting the cloud to orchestrate multiple datacenters simultaneously.

Saffron, of course, offers its own AI platform to make sense of certain data and to improve that capability, adding value to general processing capabilities provided by Intel chips.

Conclusion

The advent of the internet of things is a positive development for Intel, as it spurs growth for a host of Intel products. Most notable of these, considering the astronomical amounts of data involved, are Intel’s server chips.

But also demand for network gear and tiny chips that power some of the sensors, Intel has also embarked on offering its own IoT platform solutions for a considerable variety of sectors and applications.

Whilst not immediately tapping into any of its competitive advantages (this is more stuff for Cloud platform companies), Intel is also emerging as an important IoT platform player in its own right, offering integrated solutions in a host of markets and niches.

Whilst many of these activities are probably margin -dilutive and require a heavy dose of capital expenditures, they are simply required as a way to expand the market for Intel’s chips and make the company more relevant in growing markets for semiconductors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.