When I was going through the fourth-quarter portfolio changeout in November, I had Home Depot (NYSE:HD) come up as a growth and income stock in my screen and I was excited to have it in the portfolio. The problem at the time was how much to invest in the darn thing. At the time, the stock was trading near overbought territory relative to the rest of the market while the bullish sentiment was dying out on a momentum basis. I didn’t want to invest a full position at the local highs to only find it significantly devalued shortly thereafter, but I also didn’t want to miss on any potential upside. So what I ended up doing was initiating a half position in the name and haven’t bought any additional shares since then in the Portfolio of 12. I did, however, purchase a batch for my 401k at the beginning of 2017, and in both portfolios, the shares are up, but I believe it is always prudent to do homework even if the positions are positive.

During the past five years, Home Depot has increased its dividend during the first quarter of each year with an ex-dividend usually falling in the middle of March, and this year should be no different. Over those past five years, Home Depot has a five-year dividend growth rate of 19.4%, and those fine guys and gals over at Markit anticipate that Home Depot should be increasing the dividend by double digits again this year. The firm believes that Home Depot can increase the dividend by nearly a 14% rise to $0.79 from the prior $0.69. Home Depot has been able to increase the dividend over the past seven years while yielding lower than the 10-yr treasury (2% to 2.4%). Over the past year, the company has paid $3.3B in dividends on operating cash flow of $9.9B so increasing it by double digits should be pretty easy.

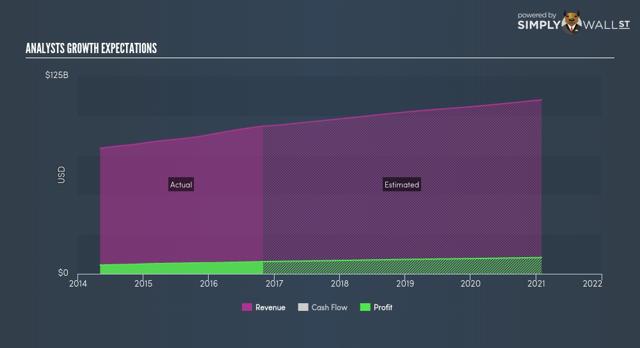

Source: simplywall.st

Earlier in January, the Consumer Electronics Show took place in Vegas and Barclays came out with the feeling that the real winners of the show were the appliance and connected home product industry. Still just in the early innings of the industry, connected home products should become more ubiquitous in the next decade or so and Home Depot definitely stands a chance to win as the consumer upgrades their appliances. Future growth is what Home Depot investors are all about as earnings are expected to grow 13% this coming year and 13.7% over the coming five years. Just check out the graph below at the projected growth profile for the company for confirmation on the sentiment strength of the future of this company.

Source: simplywall.st

In mid-January, Bank of America (NYSE:BAC) stated that Home Depot is one of its top retail picks for the year with the statement of “more bullish than ever” being thrown around. Now that particular phrase in general kind of scares me and in lots of instances may actually signal a top; hopefully, that isn’t the case for Home Depot. The thesis behind home improvement is that GDP growth is anticipated because the economy is humming along quite nicely now as indicated by the jobs report on 03 Feb. 2017. Aiding that GDP growth will be a future with potentially lower taxes and less regulation. To support BofA’s vote of confidence, just in the past three months, two different directors purchased shares in the company. On 18 Nov. 2016, Director Jeffery Boyd purchased 10k shares at $128 while eleven days later Director Mark Vadon purchased 15k shares at $129.

With the Dow Industrials Average Index now hovering around 20k, Home Depot has gained over 400% since 2009 when the Dow Industrials has just gained 100%. It’s understandable why it has gained so much in that time as we all know that there were a lot of foreclosures at the turn of the decade which caused investors to snatch up homes for a song and refurbish them to sell them at higher prices. Those that couldn’t foreclose or move because of negative equity on the house were forced repair the issues that were going on with the current residence until the equity was built back up so that they could move. Now that the economy is humming along again, home owners are starting to repair and upgrade their homes once again and all these scenarios play right into Home Depot’s wheelhouse.

The turn of the decade was probably a time that Home Depot should have gone bankrupt with all the uncertainty surrounding the housing market, or at least taken an injection from Warren Buffett, but it didn’t need to. Retail investing has been a fickle beast these days. As an owner in shares of VF Corp. (NYSE:VFC), I feel the pain. But the retail spot that I’m not concerned about is Home Depot. It just continues to hit an all-time high after all-time high it seems like. I feel that Home Depot is a value growth stock, which might sound weird, but just think about it.

I actually initiated my position in Home Depot in late November and have been pretty happy with the purchase thus far. But I will not purchase shares until it gets below $124, because I believe that is where it offers additional value. I’ve selected $124 because it is the middle of the 52-week range.

I swapped out of KLA-Tencor (NASDAQ: KLAC) for Home Depot during the 2016 fourth-quarter portfolio change-out because I ended up turning a profit in the name (14.3% or 72.1% annualized) and wanted to lock in those profits. I have lost out on some gains since the swap because of the recent resurgence by KLA-Tencor since January. For now, here is a chart to compare how Home Depot and KLA-Tencor have done against each other and the S&P 500 (NYSEARCA: SPY) since I swapped the names.

At the end of the day, it only matters what a stock has done for one’s portfolio. For me, Home Depot is one of my smaller sized positions and has been doing well, as I’m up 5.2% on the name, while the position occupies roughly 4.8% of my portfolio. I continue to believe in the name because it still has great earnings growth projections for the near and long term. I own the stock for the growth and income portion of my Portfolio of 12, and I will continue to hold onto the stock for now. The portfolio is up 14.5% since inception, while the S&P 500 is up 10.2%. For 2017, the Portfolio of 12 is up 4.3% while the S&P 500 is up 2.3%. Below is a quick glance of my portfolio and how each position is performing. Thanks for reading, and I look forward to your comments.

|

Company |

Ticker |

% Change incl. DIV |

% of Portfolio |

|

Skyworks Solutions Inc. |

(NASDAQ:SWKS) |

14.20% |

10.45% |

|

Electronic Arts Inc. |

(NASDAQ:EA) |

10.18% |

3.73% |

|

Facebook, Inc. |

(NASDAQ:FB) |

7.65% |

9.35% |

|

The Home Depot, Inc. |

5.18% |

4.79% |

|

|

Eaton Vance Corp |

(NYSE:EV) |

3.91% |

4.73% |

|

AbbVie Inc. |

(NYSE:ABBV) |

2.06% |

3.80% |

|

Diageo plc |

(NYSE:DEO) |

1.70% |

10.20% |

|

Silver Wheaton Corp. |

(NYSE:SLW) |

-2.10% |

7.51% |

|

General Electric Company |

(NYSE:GE) |

-4.10% |

4.70% |

|

Starbucks Corporation |

(NASDAQ:SBUX) |

-6.25% |

4.93% |

|

V.F. Corporation |

-7.90% |

7.95% |

|

|

Gilead Sciences Inc. |

(NASDAQ:GILD) |

-11.10% |

20.71% |

|

Cash |

$ |

7.14% |

Disclaimer: This article is in no way a recommendation to buy or sell any stock mentioned. This article is meant to serve as a journal for myself as to the rationale of why I bought/sold this stock when I look back on it in the future. These are only my personal opinions and you should do your own homework. Only you are responsible for what you trade and happy investing!

Disclosure: I am/we are long HD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.