General Electric (NYSE: GE) palms down has been, and continues to be, probably the greatest managed firms of the world. What’s fascinating is when most individuals hear ‘GE’, they consider Jack Welch, washing machines, and lightweight bulbs. Mr. Welch retired in 2001 as Chairman and CEO of GE and plenty of of his finest performing companies have been divested since. The business he constructed from the bottom up, GE Plastics, was offered in 2007 to Saudi Arabia Basic Industries Corporation (TADAWUL:SABIC); GE’s most worthwhile enterprise, GE Capital, was divested in items throughout 2015 & 2106; and, the Appliance enterprise was offered in 2016 to Haier Electronics Group Co Ltd (NASDAQ: HRELF). There at the moment are rumors that the enduring Lighting enterprise, courting again to Thomas Edison, is on the block.

However, GE continues to be making machines – very huge machines – jet engines, oil & gasoline exploration, well being care, generators, and many others. They will proceed to promote this stuff and the associated upkeep companies and spare components. However, the actually thrilling factor about GE is what they’re doing on in expertise – the connectivity of machines to the web and intranets of the world. GE is remaking themselves into a knowledge and software program firm. The Internet of Things (IoT) is probably the most thrilling play and why I like GE as a lot as I do – connecting individuals, information and machines.

Source: news.com

Internet of Things (NYSEMKT:IOT)

GE has an working system put in in a lot of their machines known as Predix; it very nicely may very well be the subsequent huge productiveness leap in trendy instances.

As talked about on their website, ‘Predix, the platform for the Industrial Internet, is powering digital industrial companies that drive the worldwide economic system. By connecting industrial gear, analyzing information, and delivering actual-time insights, Predix-based apps are unleashing new ranges of efficiency of each GE and non-GE belongings.’

Machines that acquire information to immediate evaluate of waste and drive efficiency in chopping gas consumption, system inefficiencies, and many others. – saving billions and billions of makes this platform invaluable.

Think about this working system being loaded on each machine that GE makes (in addition to their provide chain companions), connecting all of them by way of the web, amassing huge quantities of information and with the ability to have the methods generate information analytics. GE is (could also be) to machine connectivity as Apple (NASDAQ: AAPL) is to the cell phone / web world.

This is a few thrilling stuff!!

General Electric’s Chief Information Officer (CIO), Jim Fowler, has been main the IoT transformation at GE. They are additionally remodeling how IT interacts with the remainder of the GE enterprise. However, as Fowler mentions, ‘The problem lies in turning the Titanic – we have to shift our focus in a number of key areas and so they will not be simple. But if we’re considerate we are able to make the required adjustments to ship on creating the brand new IT, connecting individuals, information and machines. Leveraging our trade area experience, technical expertise and buyer insights to resolve actual, international challenges in a means that nobody else can.’

Culture Changes

With all of those thrilling actions taking place at GE, their inventory has probably not been performing all that nicely (down four.57% within the final 52 weeks). The market doesn’t seem to have priced this nice IoT worth into its inventory. There can be the truth that GE is changing culturally from the exhausting charging Jack Welch fashion to a softer strategy to draw Millennials to the workforce. For occasion, they dropped their annual efficiency critiques that Welch drove so nicely and that made GE what it’s as we speak. Instead of drills on Six Sigma, executives can now take programs on mindfulness. The effectiveness of those ‘sensitive feely’ approaches stay to be seen.

Some say it’s time for the Jack Welch fashion to be reincarnated – in all probability one of the best particular person for that CEO function could be Jeffery Bornstein, the present CFO and a throwback to the efficiency-pushed Welch period.

Analysis

Nothing very thrilling on their Earnings Per Share (EPS), Price/Earnings (P/E) or dividend yield. GE’s EPS (TTM) is $1.08 vs. $three.47 within the Industrial Conglomerate trade. The P/E is 26.84 whereas it dividend yield is three.31%.

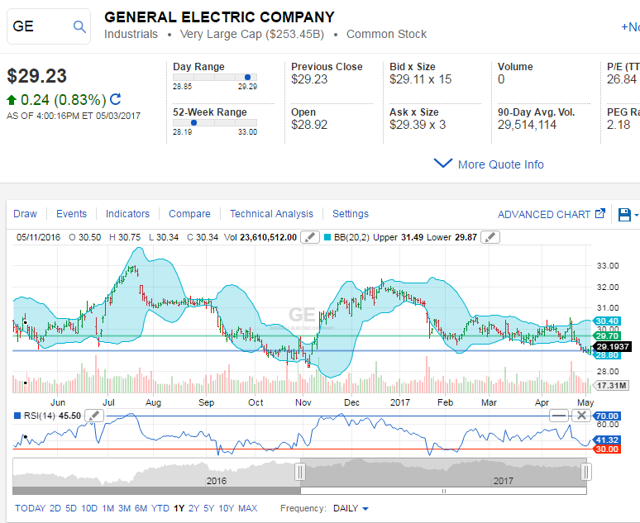

GE has been vary sure technically for a lot of the yr. Support is 28.80 whereas resistance is roughly 29.55.

Source: Fidelity Investments chart

When the market realizes the worth of GE and its foundational function within the IoT, it’s best to see high line progress, greater margins, and a better inventory value. Let’s simply hope the social experiments taking place inside the firm do not destroy the worth of the exceptional Predix expertise and firm.

Disclosure: I’m/we’re lengthy GE.

I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.