Performance and Valuation Prime™ Chart

Lam Research Corporation (NASDAQ:LRCX) designs, manufactures, and services semiconductor processing systems used in the fabrication of integrated circuits. By establishing close partnerships with their customers, and rapidly innovating and delivering key products, services, and capabilities at scale, LRCX has managed to achieve a leadership position in an industry with material growth tailwinds. As the markets for machine learning, virtual reality, connected cars, and the Internet of Things continue to expand, demand for increasingly powerful memory and logic chips is driving demand for innovative equipment and technologies. With LRCX at the forefront of pioneering technologies such as 3D NAND, multiple patterning, and FinFET, the firm is well positioned to benefit from these substantial tailwinds.

Prior to 2012 LRCX had seen fairly volatile profitability, with UAFRS-based ROA ranging from -2% to 37%. However, since acquiring Novellus in 2012, LCRX has seen Adjusted ROA improve and stabilize, climbing from 11% in 2012 to 23% in 2016. Meanwhile, despite shrinking their UAFRS-based Asset base by 6-15% from 2002-2005, LRCX has grown their Adjusted Asset base consistently since 2006, by 7-33%, excluding 1% Adjusted Asset shrinkage in 2009.

While part of the reason for LRCX’s improvement was their intelligent strategy, another important thing has happened for the company in the last several years, driving Adjusted ROA sustainability: their customers, in the memory space in particular, have consolidated.

Often when a company’s customers become more concentrated, this creates a risk, because the customers gain pricing power as they increase as a percentage of revenue. Over the last 3 years, 4 customers have each contributed more than 10% of LRCX’s revenue. However, for a supplier of capital equipment, there can be a positive to consolidation among customers: stability.

In the past several years, the number of major players in the NAND and DRAM space has come down to largely 4 entities (Micron, Samsung, SK Hynix and TSMC). This has made strategy in the industry more visible, meaning capex cycles are becoming, if not always more rationale, at least more stable.

LRCX’s customers are seeing material, steady growth in demand for their products, which helps guarantee demand for LRCX’s offerings. Moreover, the idea of a cartel approach is often overstated for their customer base. With most marginal players having now been removed, the risk of huge swings in productivity as competitors try to take share while they struggle at the margin is reduced. This helps reduce the boom-or-bust cycle in demand for their capital equipment that LRCX used to have to suffer through. These factors help explain LRCX’s sustained Adjusted ROA the last several years, and help point to why it may persist in the future.

For context, the PVP chart below reflects the real, economic performance and valuation measures of Lam Research Corporation after making many major adjustments to the as-reported financials. This chart, along with all of the charts included in this article, as well as the detail behind the graphics, can be found here.

The four panels above explain the company’s historical corporate performance and valuation levels plus consensus estimates for forecast years as well as what the market is currently pricing in, in terms of expectations for profitability and growth.

This analysis uses Uniform Adjusted Financial Reporting Standards (UAFRS) metrics, or adjusted metrics, which remove accounting distortions found in GAAP and IFRS to reveal the true economic profitability of a firm. This allows us to better understand the real historic economic profitability of a firm as well as allows for better comparability between peers. To better understand UAFRS, please refer to our explanation here.

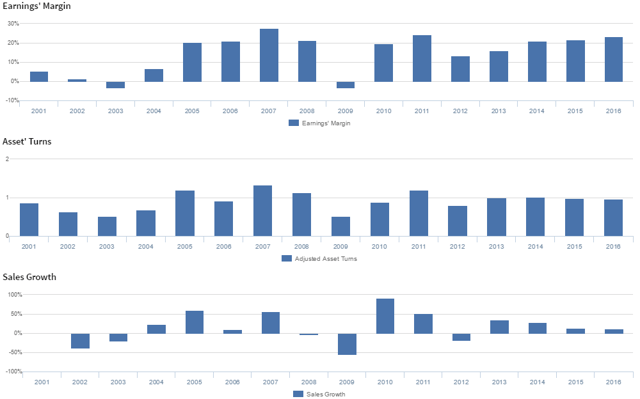

Performance Drivers – Sales, Margins and Turns

It can be helpful to break down Adjusted ROA into its DuPont formula parts, UAFRS Earnings Margin and UAFRS Asset Turnover, which are cleaned up margins and turns metrics used to calculate Adjusted ROA. The chart below details both Adjusted Earnings Margin and Adjusted Asset Turns historically, to help us better understand the drivers of the firm’s profitability and performance.

As might be expected in a capital intensive business like semiconductor equipment, trends in Adjusted ROA have been amplified because trends in UAFRS-based Earnings Margins and UAFRS-based Asset Turns track together, due to the high fixed costs of the business. From 2001-2011 Adjusted Earnings Margins were volatile, ranging from -4% to 28%. However, since the aforementioned Novellus acquisition, they have steadily improved from 13% in 2012 to 23% in 2016. Meanwhile, Adjusted Asset Turns, which exhibited similar volatility from 2001-2012, ranging from 0.5-1.3x, have since stabilized at 1.0x levels.

Embedded Expectations Analysis

As investors, understanding what the market is embedding in the stock price in terms of expectations is paramount to making good decisions. Without understanding what the market is pricing in, it is impossible to claim that the market is wrong. We derive market expectations for the firm from valuations and historical performance trends, to give a clearer picture into what the market is projecting for the firm.

LRCX is currently trading at a 10.6x UAFRS-based P/E, which is near historical averages. At these levels, the market is pricing in expectations for declining Adjusted ROA, from 23% in 2016 to 10% in 2020, accompanied by 12% Adjusted Asset growth that is in line with growth rates for the past 5 years.

Analyst and Management Expectations and Alignment

Analysts have expectations for a slower decline in Adjusted ROA than the market, projecting Adjusted ROA to decline only to 20% in 2018, accompanied by 7% Adjusted Asset growth.

However, Valens’ qualitative analysis of the firm’s Q1 2017 earnings call highlights that management is confident in their ability to deliver significant enhancements of capabilities, and about their ability to gain market share during foundry/logic node transitions. Additionally, they are confident about the positive trends underlying 3D NAND, and about their ability to deliver profitable growth. However, they appear concerned about the sustainability of non-GAAP net income growth.

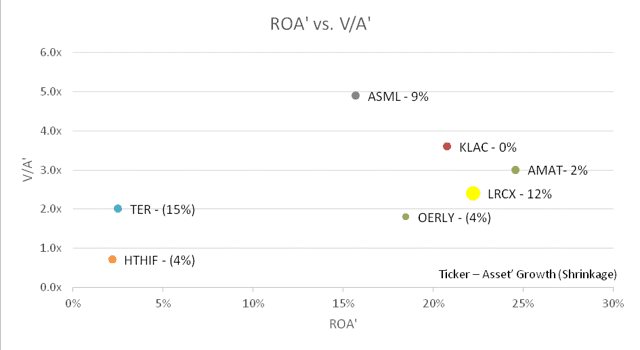

Peer Analysis – Valuations Relative to Profitability

A major benefit of adjusting as-reported financial statements is to clear away accounting distortions, to allow for more accurate peer-to-peer comparisons. To this end we have included a scatter chart below, that plots LRCX against its peers based on their Adjusted Price-to-Assets ratio (P/B) and Adjusted ROA.

Looking across industries, markets, and time, there has been a very strong relationship between a company’s Adjusted ROA relative to the corporate average (6%) Adjusted ROA, and the multiple the market will pay above the value of the company’s Adjusted Asset base, in terms of a UAFRS-based P/B (V/A’) multiple. A company that generates a 6% Adjusted ROA will tend to trade at a 1.0x Adjusted P/B, and company that generates a 18% Adjusted ROA will trade at a 3.0x Adjusted P/B, etc.

Relative to its peers in the semiconductor equipment space LRCX appears slightly undervalued with its 2.4x Adjusted P/B and 22% Adjusted ROA. While ASML Holding (NASDAQ:ASML) and KLA-Tencor (NASDAQ:KLAC) trade at richer 4.9x and 3.6x Adjusted P/B’s respectively, they generate weaker Adjusted ROA’s, at 16% and 21% respectively. This dislocation alone implies room for multiple expansion for LRCX. Moreover, when viewed with the firm’s projected Adjusted Asset growth, LRCX appears even more undervalued. Relative to peers LRCX has the most robust projected Adjusted Asset growth, at 12%, while firms trading at higher multiples, particularly KLAC and AMAT, have little to no growth prospects.

Also, it is worth noting that their closest peer, in terms of business model, is ASML. Not only has ASML had weaker profitability than LRCX, they also trade at a higher valuation. Given LRCX’s substantially more robust growth prospects relative to peers, Adjusted ROA near industry highs, and Adjusted P/B levels that are below peers, material multiple expansion appears warranted.

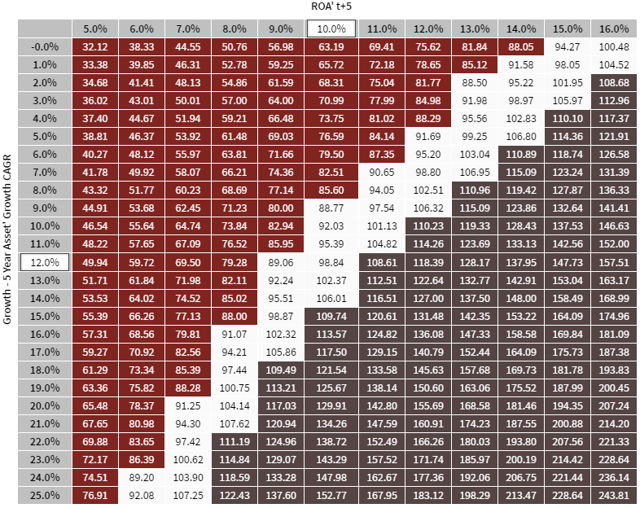

Valuation Matrix – ROA’ and Asset’ Growth as Drivers of Valuation

When valuing a company, it is important to consider more than a singular target price, and instead the potential value of a firm at various levels of performance. The below matrix highlights potential prices for LRCX at various levels of profitability (in terms of Adjusted ROA) and growth (Adjusted Asset growth). Prices that are in excess of 10% equity upside are highlighted in black, and prices representing an excess of 10% equity downside are highlighted in red.

To justify current prices, LRCX would need to see Adjusted ROA fall by over half to just 10%, levels not seen since the early 2000s. Considering the firm has seen Adjusted ROA stabilize at +20% levels since the 2012 acquisition of Novellus, these expectations appear very bearish. Should the firm succeed in just sustaining Adjusted ROA at current levels, material equity upside would be warranted. Moreover, if the firm can continue improving Adjusted ROA, as their management believes they can, equity upside of more than 150% would be warranted.

While some investors may have concerns about the risks commonly associated with the highly cyclical semiconductor industry, these fears appear overblown. While cyclicality and the effect of supply/demand can and will trickle down to equipment suppliers, the impact will be muted by the firm’s service relationships and robust backlog. Moreover, with machine learning, virtual reality, connected cars, and the Internet of Things requiring unprecedented scaling of performance and power, growth tailwinds for the industry should remain robust in the future. Given LRCX’s leadership position in technologies such as 3D NAND, multiple patterning, and FinFET, the firm appears perfectly poised to benefit from these substantial growth opportunities. Furthermore, relative to peers in the semiconductor equipment space, LRCX appears substantially undervalued given its Adjusted ROA levels and growth prospects. Therefore, considering management’s confidence about their ability to deliver profitable growth and gain market share, market expectations for declining Adjusted ROA appear much too bearish, and equity upside may be warranted.

To find out more about Lam Research Corporation and how their performance and market expectations compare to peers, click here to access the open beta of the Valens Research database.

Our Chief Investment Strategist, Joel Litman, chairs the Valens Equities and Credit Research Committees, which are responsible for this article. Professor Litman is regarded around the world for his expertise in forensic accounting and “forensic fundamental” analysis, particularly in corporate performance and valuation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.