Rising mobile search volume is putting pressure on Alphabet Inc’s margins.

Changes in the way people access the internet are causing some trouble for Mountain View, California-based search engine giant Alphabet Inc (NASDAQ:GOOGL), formerly known as Google. People are no longer waiting to reach their home or office to access their desktops. Rather, more and more people are googling on their mobile devices. More searches are happening on mobile than on desktop. This shifting trend represents both an opportunity as well as a challenge for Google. During the latest earnings call, Google’s CFO Ruth Porat mentioned mobile as one of the important growth drivers. However, rising mobile search is also impacting Google’s margins. In its latest quarterly earnings release, Google’s parent Alphabet reported a miss on its earnings, largely due to the decline in cost per click, which was impacted by the increase in mobile search.

Google mobile ads get more clicks but make less money.

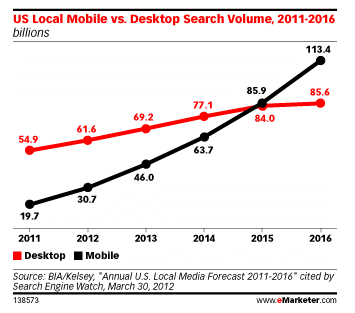

For a while now, mobile search has been growing at a much faster clip than desktop search. According to marketing research firm, eMarketer, in the United States, mobile search volumes surpassed desktop search volumes last year. The rising growth in mobile search has benefitted Google as it has been able to corner a large part of the mobile search business. According to Digital marketing firm Merkle, Google received 96% of all search-ad clicks on mobile devices in the fourth quarter.

Source: eMarketer

However, the problem for Google is that mobile ads fetch lesser money than desktop ads. Cost per click, or the money google makes every time a user clicks an ad continued to fall in the fourth quarter. Google’s strategy for mobile has largely been to either figure out new advertising formats, or generate more money from the much larger volume of impressions mobile devices generate. Until now, Google has been able to offset its declining cost-per-click with more impressions to generate impressive results. But Google will need to figure out a way to improve its cost-per-click on mobile.

Google is facing a rising threat from Amazon Inc.

The predominance of mobile is also changing the way people search. People looking to travel are more likely to search on the Priceline or Expedia app, rather than going through Google search. The same is the story with shopping. People who are planning to buy products are more likely to start their search on Amazon, than on Google. According to a report on Business Insider, Amazon is slowly eating into Google’s territory by becoming the go-to place for eCommerce search. Around 52% of people start their search for online shopping on Amazon, and only 26% use search engines like Google as the starting point. While Amazon is currently a tiny player in the ad business with its 2016 ad revenues coming in at $1.2 billion, compared to Google’s $79 billion, the rise of Amazon’s Alexa could be a serious threat to Google.

Yet another trend which is likely to benefit Amazon is the rise in voice searches. With the arrival of personal assistants like Apple’s Siri, Google Allo, Amazon’s Alexa and Microsoft’s Cortana, more people are finding it convenient to use these digital assistants, rather than typing a question into the search bar. Globally, voice-based searches jumped from almost zero to 10% in 2015 and doubled to 20% in 2016. With more people using voice searches, the importance of devices like Amazon’s Echo and Google Home is only likely to increase. And currently, Echo is clearly the more popular device. Also, Alexa is finding its way into devices of several other companies like Ford, and even Google’s Android ecosystem for that matter. Chinese firm Huawei Technologies, which manufactures android based smartphones announced during CES 2017 that its flagship handset will come with an app which will give its US users access to Alexa. According to Jan Dawson of Jackdaw Research, “To the extent that voice becomes more important and something other than Google’s voice assistant becomes the most popular voice interface on Android phones, that’s a huge loss for Google in terms of data gathering, training its AI (artificial intelligence), and ultimately the ability to drive advertising revenue,”

Alphabet stock is still a good buy.

The shift in search trends are clearly a concern for Google. However, the company is making several efforts to capture more value from mobile ads. Google recently introduced new tools and features to AdWords to specifically address the consumer shift towards mobile, which will allow it to generate more value from mobile ads. In spite of these rising headwinds, Alphabet stock remains a good long-term buy. The average analysts’ price target of $990 indicates an 18% upside for GOOGL stock from the current price.