The threat rising interest rates pose to financing has kept a lid on small-cap returns. However, some small-cap technology stocks have rallied significantly this year. While no one knows if these fast-growing small companies will continue to reward investors next year, these three stocks are winning new business in big markets ripe for disruption, and that may make them the perfect stocks to add to growth portfolios now.

Image source: Alarm.com.

No. 1: Managing the Internet of Things

Internet-connected devices are creating long-tail revenue opportunities for companies that help consumers manage them, and one of the most intriguing of these Internet of Things plays is Alarm.com Holdings Inc. (NASDAQ:ALRM), a small-cap company that’s reimagining how homeowners monitor and interact with their homes.

Alarm.com merges security with convenience through a simple, one-stop online portal that allows consumers to do things like monitor their home, manage their home’s temperature, and control lighting. The single-portal approach is resonating with consumers. Alarm.com already boasts 2.6 million subscribers, and that figure should continue growing, given that the home security market alone includes over 22 million homes. As of August, Alarm.com’s installers were adding between 10,000 and 15,000 properties per week to their service.

The majority of Alarm.com’s sales come through profit-friendly recurring revenue streams (service and licenses), and with a renewal rate of 93%, there’s plenty of clarity into future sales and profit. In Q2, total revenue clocked in at $64 million, up 24% year over year, and adjusted EPS were $0.15, up from $0.04 a year ago.

The trend toward outfitting homes with 21st-century technology should offer intriguing growth opportunities for Alarm.com, and since Alarm.com already makes money, cross-selling additional services to an increasingly bigger customer base makes this company’s future look pretty secure.

Image source: LogMeIn.

No. 2: Simplifying collaboration

LogMeIn, Inc. (NASDAQ:LOGM) appears better positioned than anyone else to provide businesses and employees with convenience and flexibility. LogMeIn is well known for software-as-a-service solutions that allow people to access devices and collaborate together from anywhere, and in July, the company announced that it’s combining with Citrix‘s GoTo business to form a $1 billion-revenue cloud software company.

After determining that GoTo’s video communication solutions weren’t core to its long-term strategy, Citrix decided to spin off GoTo last year. Acquiring GoTo will add roughly $630 million in sales to LogMeIn’s already fast-growing top line. It will also offer LogMeIn an opportunity to cross-sell its legacy products to GoTo’s massive client base. Further, LogMeIn is targeting a profit-friendly $65 million in cost savings during the first year following the combination of the two companies, and $100 million or more in savings per year over time.

LogMeIn’s sales grew 22% year over year to $85.1 million in Q3, and its $0.56 in EPS was nicely above the $0.46 reported in the same quarter a year ago. Management thinks LogMeIn’s full-year sales will eclipse $335 million, and its non-GAAP EPS will exceed $1.98 this year. If the company delivers on those targets, it will represent a big jump from sales of $271.6 million and non-GAAP EPS of $1.66 in 2015.

Overall, the upcoming integration at LogMeIn could make it a powerhouse in cloud productivity software, and for that reason, I think there’s room left for shares to run higher.

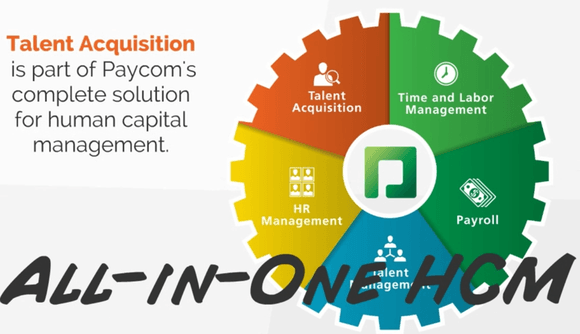

No. 3: Streamlining human resources

Small and mid-size companies often roll in HR solutions as they grow, and that approach can create fragmented HR databases that provide incomplete and contradictory insight. Paycom Software Inc.‘s (NYSE:PAYC) single-database HR solution eliminates the headaches associated with integrating multiple vendors, allowing clients to better manage HR functions, such as recruitment and onboarding, payroll, and benefit management.

Image source: Paycom.

Paycom’s one-stop software solution is resonating with companies. In Q2, Paycom’s revenue jumped 51% year over year to $73.9 million, and its non-GAAP EPS more than doubled to $0.21 from $0.10. Management predicts that its full-year sales will surpass $325 million this year, up from $224.7 million in 2015 (which itself was up 49% from 2014!), and that has industry watchers targeting EPS of $0.77 in 2016 and $0.96 in 2017.

Although the HR-solutions market is competitive, Paycom is one of the only solution providers that was built from the ground up for the Internet, and frankly, I think its Midwest HQ provides it with some cost advantages over competitors located in pricier markets, such as California. While large companies are likely to continue sticking with software solutions that bigger companies offer, including Oracle, I think there’s still a significant greenfield opportunity for Paycom in the mid-size market. If I’m right, then Paycom should be able to continue delivering robust double digit growth in 2017, and that could make its shares worth stashing away.

Todd Campbell has no position in any stocks mentioned. Todd owns E.B. Capital Markets, LLC. E.B. Capital’s clients may have positions in the companies mentioned. Like this article? Follow him on Twitter, where he goes by the handle @ebcapital, to see more articles like this.

The Motley Fool owns shares of Oracle. The Motley Fool recommends Alarm.com Holdings and Paycom Software. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.