Image Credit: PV Magazine

In 2016, clean energy giant SunEdison set its sights on acquiring Vivint Solar, a rooftop solar panel installation company. In what unfolded as a sordid affair, Vivint terminated the deal.

SunEdison didn’t have the funds to make good on the agreement due to an ill-advised acquisition spree. In order to recoup, it looked like Vivint would have to rely on a lawsuit against SunEdison for breach of contract, and would turn back to its original business model with a diminished stock offering. In essence, the business’ association with SunEdison — a company that flew too close to the sun — saw Vivint in danger of melting away.

Fast-forward to 2017, and Vivint is emerging from the ashes with a more high-tech focus on sustainability. Vivint Smart Home — Vivint Solar’s sister company — will provide solar-powered automation to houses. The two are now partnering to combine Vivint Solar’s approach to clean energy with emerging smart-home tech.

Instead of buying the solar panels, homeowners lease them. Technicians install the panels at the same time they install connected tech, such as Amazon Echo, smart locks, smart thermostats and security systems. Customers control the entirety of the automated setup through the SkyControl panel, which looks very much like an iPad mounted on the wall.

But this comes at a time when Tesla (which recently changed its name to Tesla Inc. to indicate the company is doing more than just cars) is rolling out its solar roof offering. The Tesla solar tiles will channel energy to a battery, which could conceivably allow a home to run on solar power indefinitely. The battery could also power a smart home. There’s still no word on how much it costs. Regardless, Tesla is on a roll, gaining high visibility in a solar roof competition with Vivint.

When it comes to Tesla’s original offering, electric vehicles (EVs), the high-profile tech company has surpassed Ford in market value (as of this writing, Tesla’s market capitalization is at $48.7 billion, compared with Ford’s $45.6 billion). Investors see Tesla as a promising long-term investment. Because Tesla is first and foremost a car company focusing on EVs and automation, there’s no mention of how its new solar roofs will contribute to market value. Solar power and Tesla EVs can be part of a package for homeowners, who could ostensibly power both their home and charge their car with solar.

In comparison with Tesla, Vivint is an underdog on humble ground. Because of the SunEdison fiasco, shares on Vivint stock plummeted 74 percent and still haven’t recovered. CEO David Bywater told Bloomberg the company is operating on a “sustainable growth” strategy, pursuing per-watt profitability instead of massive growth. Although Vivint doesn’t integrate with electric vehicles yet, that’s part of the long-term plan.

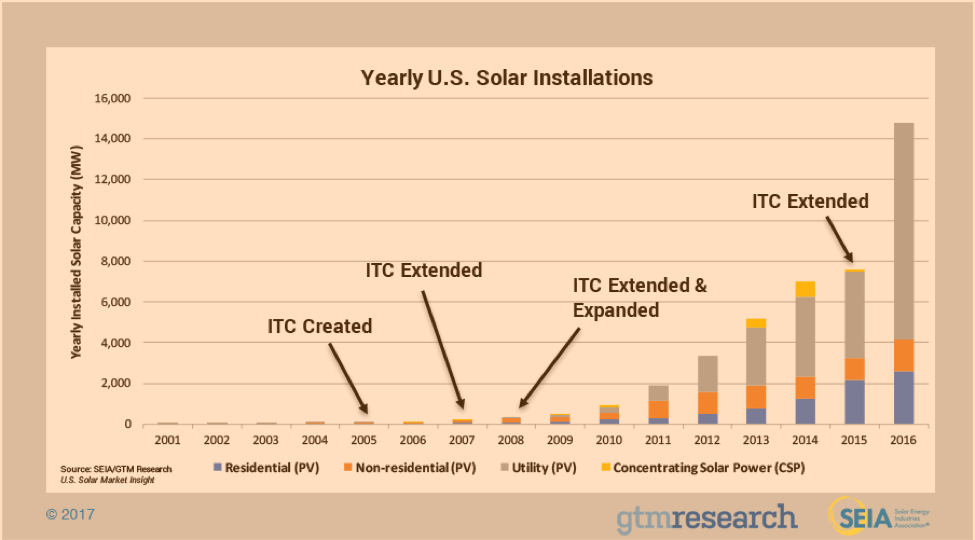

Vivint’s battle towards sustainability and profitability comes at a time when solar technology is vastly improving. Silicon solar cells operate at an efficiency rate of about 16 percent, compared to 4 percent for old solar cells. Between 2010 and 2014, prices for solar panels dropped 63 percent. From 2015 to 2016, solar installations jumped from below 8,000 to over 14,000 (in terms of capacity), as this chart from the SEIA indicates (ITC is the Solar Investment Tax Credit, which Congress extended at the end of 2015):

Even in Texas, where the energy market has been dominated by oil, natural gas and wind, solar is beginning to look like a viable alternative. The falling price of polysilicon combined with the extension of the ITC could see solar generating 17 percent of all power in the Lone Star State by 2030.

Vivint looks primed to take advantage of a growing trend toward renewable energy. Business Wire reports the renewable energy market will be worth $777.6 billion by 2019. People view solar panels as an investment, one that can save consumers money on everything from heating swimming pools to operating a farm.

Vivint is taking an innovative approach by linking solar power with smart homes, but will it pay off? Smart technology exists in an entirely different context than sustainable technology. It is associated with the Internet of Things, Artificial Intelligence and cybersecurity risks. The compound annual growth rate for connected homes has been 31 percent since 2015, and sales are projected to grow by a mere 17 percent. Connected homes have yet to make an impact in the mass market, existing in a chasm created by high prices, low demand and a low level of interoperability between devices. People who do have smart devices in their homes are waiting for them to wear out before replacing them. The devices are still so new, it could take a while before current users have fresh demand. That means there aren’t any huge innovations in new tech to incentivize further purchases.

Analysts expect the connected home market to keep growing. It’s just a matter of overcoming the issues that currently place smart homes in a chasm.

Vivint Solar and Vivint Smart Home are starting off at a crucial intersection of technologies, technologies that should see an increased level of consumer adoption down the road. Until the mass market comes home to a solar-powered space where devices do their chores for them, Vivint will remain in its recovery phase. It will continue counting on the sun to help power sustainable, smart business.