According to a recent report from McKinsey, the potential of the Internet of Things (IoT) market could have been grossly underestimated. IoT has a potential economic impact of $3.9 trillion to $11.1 trillion a year by 2025. While IoT presents an undeniable massive growth opportunity, most investors have chosen to flock to the more mature tech companies rather than smaller growth stocks in the space.

The IoT revolution set to facilitate communication between billions of connected devices has inspired tech companies from new startups to mature IT providers to quickly move in order to carve out a piece of this new exploding market. According to Intel (NASDAQ:INTC), the number of connected devices could surge from 15 billion in 2015 to 200 billion by 2020, which essentially means every person in the world could have an average of 26 smart appliances.

Another report from research firm IDC says the IoT market will accelerate from $655.8 billion in 2014 to $1.7 trillion in 2020, registering a 16.9% compounded annual growth rate. “While wearable devices are the consumer face of IoT, the real opportunity remains in the enterprise and public sector markets,” Vernon Turner, IDC senior vice president and research fellow (IoT) enterprise systems, said.

Despite the bright prospects of the industry, IoT will have to overcome a number of challenges. For instance, data breaches like the past hacking of Sony (NYSE:SNE) as well as other high-profile attacks on Target (NYSE:TGT) and Home Depot (NYSE:HD) have not been a great motivator for consumers to buy more web-enabled products.

The recent Mirai botnet attack, which took down major websites across the world, turned IoT devices like unsecured routers and IP cameras into bots to carry out DDoS attacks, flooding sites with traffic until they crashed. Experts have also demonstrated how attacks that were blocked on PCs years ago can still be used to hack various IoT devices. What’s more, no dominant set of standards yet exist for connecting different devices to each other and to larger networks, which could hinder the industry’s future prospects.

With that being said, we will discuss two well-known players in the IoT space and two little known companies that could soon be making major waves.

Where to look for value in IoT

Much like other legacy tech companies, Cisco Systems (NASDAQ:CSCO) has shifted away from its traditional hardware-based system sales to provide cutting-edge solutions in the rapidly growing IoT space. Early last year, the company bought out Jasper Technologies in a deal valued at $1.4 billion. The platform’s SaaS-based solution gives users the ability to analyze data, track performance, gain insights and quickly launch new IoT services.

In addition, Cisco’s cloud-based security segment, which is already growing by double digits, should benefit from a surge in demand for IoT security products. The company also made headlines when it announced its acquisition of AppDynamics for $3.7 billion in equity and cash, nearly double the $1.9 billion valuation it received in its last funding round when it raised $158 million.

Following the acquisition, which is expected to be complete in April this year, AppDynamics will be included and intergrated into Cisco’s IoT unit alongside Jasper. By using AppDynamics’ software, organizations will be able to monitor applications and rectify problems on different cloud offerings, which will become increasingly important as more companies transition their applications to run on various cloud platforms.

For investors looking for an investment with a margin of safety, Cisco is one of the better options out there considering it offers a solid dividend yield of 3.4% and continues to increase shareholder value through stock buybacks.

For investors with a higher tolerance of risk, one speculative play in the space that shows plenty of promise is GTX Corp. (GTXO), whose current market capitalization is about $4 million. The company describes itself as a pioneer in the GPS wearable tech market where it leverages its patented, miniaturized and low-power consumption GPS and cellular tracking and monitoring technology as the foundation for its two-way GPS personal location-based services.

Wearables are among the key drivers of growth in IoT, particularly those centered on health care. GTX offers investors exposure to this segment. The company has a number of patents, one of which is the GPS SmartSole, a technology I believe could have far-reaching implications on the future of health care. Simply put, this is basically a smartphone hidden and sealed in an insole. It uses the same GPS and cellular technology as your smartphone, is charged like your phone and requires activation and a data service plan.

According to GTX’s fillings, approximately 2% of the American population is living with Alzheimer’s, dementia, autism, traumatic brain injury or some other cognitive disorder that often leads to wandering due to memory loss. The company believes its SmartSole could help address this problem.

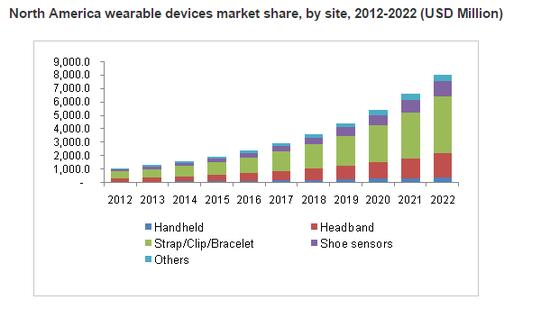

The company’s fiscal 2015 revenue increased $310,918 or 225% compared to the prior year, primarily due to the launch of the new GPS SmartSole product line. This growth still continues in the double digits. It increased revenue by 16% in the last quarter compared to the year-ago period. I recommend putting GTX on the watch list considering projections from Grand View Research expects the global wearable medical device market to grow from $3.9 billion in 2014 at a CAGR of 28% to 2022.

(Source: Grand View Research)

Keek Inc. (KEEKF) has developed an online social media application which allows users to upload and share personal videos of themselves, making it a direct competitor to Facebook (NASDAQ:FB) and Snap Inc.’s (NYSE:SNAP) Snapchat, with the market currently valuing it at around $30 million. Shares of the company have taken a beating over the past month in spite of the fact there has been no negative news creating a buy opportunity. The company may not be cash flow positive yet, but its addressable market size is definitely not something to sneeze at. In Facebook’s last earnings call, CEO Mark Zuckerberg revealed the company’s next biggest growth catalyst would be video. This is considering that more marketers are taking their ad dollars to the digital space, which research from eMarketer expects will grow in the double digits, considerably outpacing traditional TV ad spending. TV ad spending will grow by 2.5% on the higher end.

Lastly, chipmakers like Qualcomm Inc. (NASDAQ:QCOM), which have also stepped up to get a share of this lucrative market by diversifying into IoT chips, should be among the top beneficiaries as the industry grows. The company expanded its Snapdragon line of mobile chips into SoCs for wearables, connected cars and drones.

The company recently announced it would offer support for Android Things OS, integration with Amazon Web Services and two SoCs that combine a host standard, signaling it was beefing up its IoT game. Additionally, Qualcomm acquired IoT chipmaker CSR in 2015 and will soon close the acquisition of the world’s top automotive chipmaker NXP Semiconductors (NASDAQ:NXPI) in a deal valued at $47 billion.

NXP already supplies chips that control driver assistance systems in eight of the 10 leading automakers in the world. Adding these assets to Qualcomm’s Snapdragon automotive processors should give it a solid foothold in self-driving cars.

Looking at some of the company’s current valuation metrics, Qualcomm is trading at a bargain in spite of all the uncertainty surrounding it. Its price-earnings ratio is about 17.4, which is in line with its five-year average and lower than the industry median of 23.7, indicating it is trading at a discount. Its price-book ratio of 2.7 is also better than the industry average of 3.5, which implies it has the potential to offer more upside going forward.

Disclosure: I do not own stock in any of the companies mentioned.

Start a free 7-day trial of Premium Membership to GuruFocus.

About the author:

Edwin Kagunda

I’m a freelance equity research provider on the look out for new opportunities.